A good start

The beginning of 2013 marked Mercedes-Benz South Africa’s return to publishing sales data, and it’s also been joined by a few others. FRANK BEETON details how this changes the profile of the local market’s figures.

This year kicks off with some highly significant recent changes to the NAAMSA reporting regime. During March Mercedes-Benz South Africa (MBSA) resumed fully detailed sales reporting, and provided corrected historical data dating back to December 2011 – when comprehensive reporting was suspended. This has necessitated the correcting of the historical data supporting this analysis, and has, therefore, impacted on the comparisons made in these comments.

While Associated Motor Holdings (AMH) and Amalgamated Automobile Distributors (AAD) have still continued to report only aggregated MCV sales at the time of writing, these have been fully integrated into this analysis, and it should also be noted that Chinese brands First Automobile Works (FAW) and Jiangling Motor Corporation (JMC) have recently commenced full sales reporting.

These developments have ensured a considerably more complete market profile, and have substantially improved the accuracy and value of market comment offered in this report, and are warmly welcomed by FOCUS.

TRUCK MARKET RESULTS

With the completion of the first quarter of 2013, the South African market for trucks, buses and vans with gross vehicle mass (GVM) ratings of more than 3 500 kg has recorded cumulative year-to-date growth of 1,6 percent when compared to the result for the equivalent January to March period in 2012. Despite the early advent of Easter during the month of March this year, the local truck market has returned a welcome, if marginal, measure of year-on-year growth during the review quarter. This is a pleasing outcome, given the generally lacklustre economic environment that has prevailed both locally and globally over this period.

In South Africa, rand foreign exchange weakness has resulted in a succession of fuel price increases (in spite of declining international oil prices) and this has impacted on the local business mood, as reflected in the negative outlook of the results of the Kagiso Purchasing Managers’ Index published at the end of March.

It is notable that all this market growth in the first quarter was driven by the improvement in MCV sales, and the reasons for this are more fully explored in the following section. However, it is notable that MCV buyers tend to be spread across the operational spectrum from large fleets to small businesses, and also include a broad range of central, provincial and local government entities, so this performance supports the view that the local economy, while not having showed spectacular growth, has not collapsed.

SEGMENTATION DYNAMICS

The surge in MCV segment sales mentioned above has resulted in a dramatic narrowing of the gap between the market shares of this segment and the premium payload extra-heavy commercial vehicles (EHCV) grouping. At the end of the first quarter, the differential was less than one percentage point, with EHCVs narrowly retaining top spot at 40,2 percent, while MCVs had moved up to 39,6 percent. Operators purchasing vehicles in the MCV segment are extremely diverse, with the product mix being made up of distribution vehicles feeding the retail sector, panel vans used in fast freight delivery operations, small tippers serving building and renovation contractors, long-distance midibus taxis, local utility service units, and ambulances.

This diversity makes the identification of driving forces behind the recent improvement in sales challenging, but it can be said that the post-tsunami improvement in the availability of Japanese products, which dominate the chassis/cab element of the MCV segment, and some increased governmental buying activity in the panel van arena, have been significant contributors to this growth.

The sales volume recorded by the EHCV segment during the first quarter of 2013, at 2 749 units, was remarkably similar to those recorded during the first and final quarters of 2012, at 2 748 and 2 781 units, respectively, so there has been no apparent recent collapse in absolute demand for these units.

At the end of 2012, we noted that the increased utilisation of the Durban-Johannesburg petroleum pipeline and the migration of certain vehicle transportation tasks from road to rail, had resulted in some softening of demand for long-distance haulage units, although Statistics South Africa’s “Land Transport Survey” monthly statistical release, which provides broad data on freight tonnages moved by road and rail, continues to show a steady 70:30 national market split in favour of road transport. We have also recently commented on the increased metropolitan usage of rigid multi-axle models on distribution duties as a factor supporting EHCV sales.

The review period has witnessed a sharp drop-off in the market share of the distribution-rich heavy commercial vehicle (HCV) segment, from just below 20 percent in the final quarter of 2012, to 16,7 percent in the quarter just ended. This reverse, following an earlier period of gradual improvement, suggests that the process of availability recovery by Japanese-sourced vehicles, in the aftermath of the 2011 tsunami and earthquake, has largely been completed. The dominant position held by Japanese products in this heavy 4×2 freight carrier category inevitably results in their availability status playing a major role in determining the segment’s volume profile, and it is notable that the first quarter 2013 sales result was almost identical, in absolute terms, to its counterpart in the first quarter of 2012.

The remaining heavy passenger bus segment has also given up volume during the first quarter of 2013, with an outcome of 240 units, compared to 275 units in the final quarter of 2012. However, as previously noted, the earlier result was substantially boosted by seasonal deliveries against provincially-subsidised school bus orders and with the small size of this segment in absolute terms, fairly substantial quarter-on-quarter volume variations are frequently encountered.

Finally, in the review of application performance within the entry-level MCV segment, it is noted that, in the first quarter, sales reported by the AMH/AAD Group had considerably raised the market profile of tipper units, and that Iveco had reported a substantially greater number of bus deliveries than hitherto. However, it is suspected that many bus units are still included in the panel van grouping, and that some tippers are still being lumped together with chassis-cab derived freight carriers. The reported MCV segment application penetration levels for the first quarter were: freight carriers 57,8 percent, integral vans 36,9 percent, buses 3,3 percent and tippers 2,1 percent.

MANUFACTURER PERFORMANCE

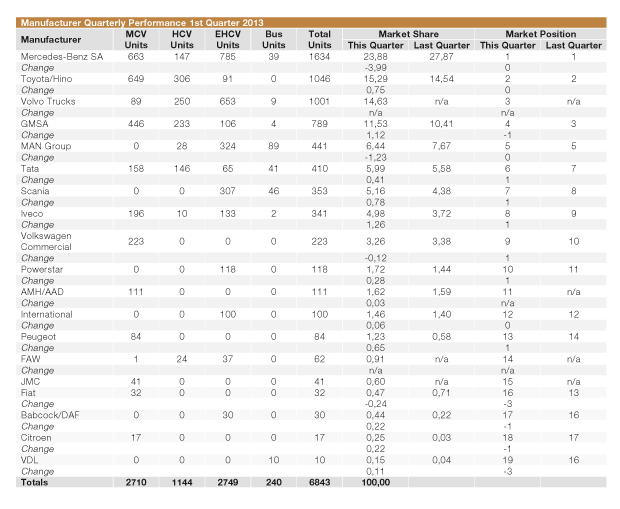

The accompanying chart illustrates the relative market performance and ranking of each participating manufacturer in the quarter just completed, as compared, where applicable, to the returns for the previous quarter.

Readers should note that the reporting changes discussed at the beginning of this article, as well as an important amendment to the composition of one large participating group, as detailed below, have made the drawing of direct comparisons between the penetration and ranking performances of all participating manufacturers/groups in the first quarter of 2013 and the final quarter of 2012 largely irrelevant. As the nature of the market composition has changed significantly, we have also not shown market ranking positions for new or radically changed market participants in the preceding quarter, or passed any comment on shifts in these outcomes.

Readers should note that the reporting changes discussed at the beginning of this article, as well as an important amendment to the composition of one large participating group, as detailed below, have made the drawing of direct comparisons between the penetration and ranking performances of all participating manufacturers/groups in the first quarter of 2013 and the final quarter of 2012 largely irrelevant. As the nature of the market composition has changed significantly, we have also not shown market ranking positions for new or radically changed market participants in the preceding quarter, or passed any comment on shifts in these outcomes.

The groupings contained in this section of the report are based on the rule that, if a manufacturer/group sells more than one brand through its distribution channels, then all sales for those brands will be consolidated in the result for the manufacturer/group. Thus, Mercedes-Benz includes Freightliner and Fuso, Toyota/Hino contains both brands, MAN includes Volkswagen (Constellation) trucks and Volksbus passenger units, but not VW commercial vans (listed separately), while Volvo Trucks now also includes UD Trucks, as well as Mack and Renault. This last change recognises the very visible and freely acknowledged connection that now exists in South Africa between the Volvo Group and UD Trucks SA.

Mercedes-Benz South Africa

The Mercedes-Benz family was placed first in the first quarter market rankings, with a group penetration level of 23,9 percent. However, the total sales volume at 1 634 units represented a decline of 15,4 percent when compared to the new corrected result for the preceding quarter. The first quarter performances of the individual brands achieved market shares of 16 percent for Mercedes-Benz, 4,2 percent for Freightliner, and 3,7 percent for Fuso, all of which suffered reduced sales volumes in comparison with their fourth quarter 2012 outcomes, by margins of 18,4 percent, 5,6 percent and 12,2 percent respectively. This group also achieved outright market leadership in the MCV and EHCV segments during the first quarter.

Hino/Toyota

The Hino-led grouping, which includes Toyota’s Dyna MCV light truck model, occupied second position in the overall first quarter listings with a market share of 15,3 percent. This followed the achievement of a 3,8 percent improvement in quarter-on-quarter volume, and was accompanied by outright volume leadership of the HCV segment. Hino is currently advertising its service and maintenance plans, and a three-year, unlimited distance warranty on the EHCV 700 Series product.

Volvo Trucks

As noted above, the incorporation of UD Trucks into the local Volvo Trucks grouping has considerably altered the complexion of this market, and has resulted in an initial third place ranking, and considerably broader market coverage, for the new conglomerate in the first quarter of 2013. An opening market share of 14,6  percent has been secured despite a consolidated quarter-on-quarter volume decline of 12,2 percent when compared to the combined output of Volvo, Renault and UD in the final quarter of 2012. Because of the significant change to the composition of this group, no market penetration or ranking details for the combined Volvo family are listed for the final quarter of 2012. UD Trucks’ current advertising activities are focused on promoting its maintenance contracts.

percent has been secured despite a consolidated quarter-on-quarter volume decline of 12,2 percent when compared to the combined output of Volvo, Renault and UD in the final quarter of 2012. Because of the significant change to the composition of this group, no market penetration or ranking details for the combined Volvo family are listed for the final quarter of 2012. UD Trucks’ current advertising activities are focused on promoting its maintenance contracts.

GMSA (Isuzu)

A quarter-on-quarter volume increment of 1,1 percent saw Isuzu Trucks SA place fourth in the January to March 2013 rankings, with an overall market share of 11,5 percent. Most of the first quarter volume improvement was driven by an increase in entry-level N-Series MCV sales.

MAN Group

The MAN Group has placed fifth during the review period, with a total market share of 6,4 percent, and overall leadership of the heavy passenger bus segment. The group suffered a 17,1 percent loss of volume when compared to its result for the final three months of 2012, with MAN achieving 5,5 percent market share on its own in the review period, and Volkswagen-branded product accounting for the remaining one percent share of the total market. Although Volkswagen Constellation truck volumes remain at low levels, the Volksbus range continues to make a substantial contribution to the group’s bus segment fortunes.

Tata

Tata is positioned sixth in the 2013 first quarter listings, with a penetration level of six percent, and a 5,9 percent volume improvement for the first quarter of 2013, over its immediate predecessor. The local arrival of the new Prima “world truck” series is still awaited.

Scania

Scania’s performance in the first quarter was characterised by an absolute volume improvement of 16,1 percent over its October to December 2012 outcome, resulting in a market ranking of seventh position, and 5,2 percent share of the total market.

Iveco

Iveco’s volume increased by nearly one-third, in the quarter-on-quarter comparison, and built on the gains that had been made by this manufacturer during 2012. This resulted in eighth position in the ranking order,  with a market penetration of five percent. Much of this improvement was gained through multiple-unit sales of EHCV units, which has been reinforced in recent publicity material distributed by the manufacturer, and it is also notable that after a year’s absence, Iveco had returned to the bus segment during the first quarter.

with a market penetration of five percent. Much of this improvement was gained through multiple-unit sales of EHCV units, which has been reinforced in recent publicity material distributed by the manufacturer, and it is also notable that after a year’s absence, Iveco had returned to the bus segment during the first quarter.

Powerstar

Powerstar was another manufacturer to achieve positive quarter-on-quarter volume growth during the January to March 2013 period. An absolute sales volume of 18 units resulted in 18 percent growth, 1,7 percent market share, and 10th position in the market rankings.

AMH/AAD

Despite the fact that AMH/AAD’s MCV segment sales are still reported only in aggregate terms, they have been included in this analysis in the interests of completeness. At this stage, the reported volumes are known to only consist of Hyundai HD Series light trucks, with total sales for the first quarter coming in at 111 units, just one more than those reported in the previous three-month period. This has resulted in an overall market share of 1,6 percent, and 11th position in the market rankings.

NC² – International Trucks

International’s market share achieved during the review period was 1,5 percent, resulting in 12th position in the market order. Absolute sales volume increased by 3,1 percent when compared to the result for the October to December 2012 period. Navistar Financial, a division of WesBank, is currently advertising dedicated financial services. There still seems to be confusion regarding the chosen identity of this operation, which is still being referred to variously as Navistar, International and NC².

FAW

Despite its active presence in the South African market for some two decades, Chinese manufacturer First Automobile Works (FAW) has only just commenced sales reporting, and now takes up its rightful place in the ranks of local market participants. FAW’s result for the first quarter was made up of 62 units across the MCV, HCV and EHCV spectrum, placing the company in 14th position with almost one percent overall market share. Current advertising is concentrated on the recently-introduced J6 premium hauler.

JMC

The final new entrant during the review quarter was another Chinese manufacturer, Jiangling Motor Corporation (JMC), who reported 41 unit sales in the MCV segment. This was sufficient for an initial 0,6 percent market share and 15th position in

the rankings.

Babcock/DAF

Babcock achieved a doubling of its final quarter volume during the review period, to the tune of 30 units sold. This generated a market share of 0,4 percent, placing the company 17th in the market pecking order. The company is currently advertising special financing deals in conjunction with Standard Bank.

VDL

Bus chassis specialist manufacturer VDL achieved a substantial sales volume improvement during the first quarter, with the ten units delivered totally eclipsing the meagre three unit total of the preceding quarter. This outcome resulted in a 19th position market ranking, with an overall market share of 0,2 percent.

European van manufacturers

Four vehicle manufacturers continue to compete in the MCV market segment of only European-sourced integral van-derived products. Of these, Peugeot and Citroen achieved quarter-on-quarter volume growth, with final sales totals of 84 and 17 units respectively, which improved on the fourth quarter 2012 returns of 40 and 2 units. This resulted in a market share of 1,2 percent for 13th-placed Peugeot, and 0,3 percent for 18th-positioned Citroen. Volkswagen Commercials and Fiat experienced volume declines – the former by 4,7 percent from its previous quarter total of 234 units, and the latter by 34,7 percent from the 49 units scored in October to December 2012. The resulting first quarter position/penetration results were ninth/3,3 percent for VW, and 16th/0,5 percent for Fiat.

Non-reporting manufacturers

Readers should please note that local sales volumes of several commercial vehicle brands, including Dong Feng, Foton and Ashok Leyland, are not yet reported to Naamsa, and are, therefore, excluded from the comments and data contained in this report.

GENERAL MARKET COMMENTS

The stability in market monthly volumes, which was characteristic of 2012, has continued into the early months of 2013. In the period immediately ahead, vehicle, parts and fuel pricing are likely to remain areas of concern to transport operators with the rand continuing to trade internationally at levels above R9 to the US dollar, but there have been no suggestions that the financing environment is under undue pressure. On the contrary, it is notable that several vehicle brands are currently advertising attractive financing arrangements. Vehicle availability, particularly in the MCV and HCV segments, appears to have normalised, and should be better in 2013 than it was last year. Interest rates are unlikely to rise until some firm signs of improved macro-economic conditions appear.

It is, perhaps, still too early to expect any significant influence from Transnet’s Market Demand Strategy on the truck market. However, the magnitude of that programme, which, involves the planned expenditure of R300 billion on capital projects over a seven-year period, and the procurement of 1 200 new locomotives and 19 400 rail wagons, raises understandable concern within the road freight industry that government’s clear commitment to supporting rail is likely to have a substantial bearing on the situation going forward.

If the Transnet strategy succeeds, however, it is likely to exert more influence on the composition of the truck market than its outright size. At this stage, however, it appears most likely that a final 2013 market result broadly similar to the 2012 total will be the most likely outcome.

Published by

Focus on Transport

focusmagsa

OUT NOW: The latest issue of FOCUS!

OUT NOW: The latest issue of FOCUS!

Big news from FOCUS on Transport + Logist

Big news from FOCUS on Transport + Logist

FUSO: Driving the Future of Mobile Healthc

FUSO: Driving the Future of Mobile Healthc

A brand

A brand

Wondering about the maximum legal load for a

Wondering about the maximum legal load for a

The MAN hTGX powered by a hydrogen combus

The MAN hTGX powered by a hydrogen combus