Big trouble for mediums?

Things aren’t looking particularly good within the medium commercial vehicle (MCV) sector. The month of April 2016, for instance, saw a massive 24,3 percent decline in sales (over the same month last year). Is this a sign of things to come, or will the market recover? CHARLEEN CLARKE reports …

It’s been a decidedly lousy year for the MCV market segment. In fact, the last two years have been somewhat troubling.

Back in 2013, this segment notched up annual sales of 11 584 units. In 2014, the MCV market was showing signs of developing a sniffle … with a mere 11 024 sales. Last year, it appeared to have got a cold, with just 10 488 units changing hands.

This year, however, it appears to have contracted the flu.

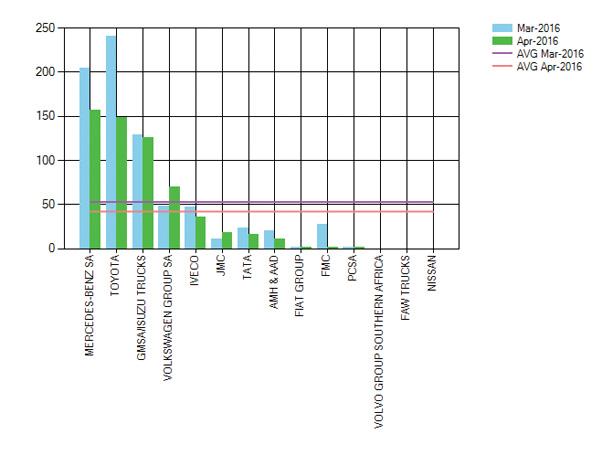

January wasn’t too bad; the market only declined by 98 units, or 15,6 percent. February was even better; reflecting a decline of just 12,9 percent, but then came March, with a thundering decline of 343 units, representing a 31,3 percent crash in this sector. April’s almost equally dismal performance saw January to April clocking in at 2 073 sales, versus 3 236 in the same period last year.

This market crash has taken many by surprise, as Kobus van Zyl, executive director of Daimler Trucks & Buses Southern Africa, points out. “The dramatic decline in the MCV market has certainly caught us by surprise. As we normally do, we are analysing the root causes. At this stage it appears that sales across all channels are down, especially government procurement,” he tells FOCUS.

However, Frank Beeton, FOCUS columnist and Econometrix consultant, says that we cannot read too much into the dwindling sales figures. “When one looks at the National Automobile of South Africa (Naamsa) sales figures, MCV sales are 23,2 percent down this year, while the entire truck market over 3,5 t gross vehicle mass (GVM) has reduced by 12,3 percent year-on-year.

However, Frank Beeton, FOCUS columnist and Econometrix consultant, says that we cannot read too much into the dwindling sales figures. “When one looks at the National Automobile of South Africa (Naamsa) sales figures, MCV sales are 23,2 percent down this year, while the entire truck market over 3,5 t gross vehicle mass (GVM) has reduced by 12,3 percent year-on-year.

“However, please remember that, because there is no detailed reporting (instead, estimated volumes) for Mercedes-Benz, these numbers are potentially inaccurate. Mercedes-Benz is an important player in the MCV segment with the Sprinter and Fuso Canter. Because of the lack of accurate Naamsa data, any market commentary can only be guesswork,” he warns.

Having said this, Beeton notes that, if one takes the reported volumes at face value then combined sales of vans and buses are down 33,6 percent (826 units versus 1 244 units). “On the other hand, combined sales of trucks and tippers are down 14,3 percent (1 648 units versus 1 922 units). Therefore the problem is more serious for van-derived units than chassis/cab units,” he reveals.

The vast majority of vans are converted into long-distance taxis. “Currently, sales of minibuses, especially Toyota Quantum/Nissan NV350, are very strong. Are we seeing a possible switch by taxi operators from converted MCV vans to light commercial vehicle minibuses?” he ponders.

Beeton adds that FAW and Fuso have some attractively priced new bottom-end models in the heavy commercial vehicle (HCV) segment. “So, maybe we are seeing a possible shift from MCV to HCV by some operators. However, the lack of Mercedes-Benz detail could hide the full effect of this,” he explains.

In addition, Beeton says that the run-out of UD’s MCV models in 2015 could have pulled some sales forward from 2016. “We also suspect major incentive activity from Isuzu late in 2015, which, too, could have pulled some sales forward from the early months of 2016. This has, however, been denied by the company,” he tells FOCUS.

In addition, Beeton says that the run-out of UD’s MCV models in 2015 could have pulled some sales forward from 2016. “We also suspect major incentive activity from Isuzu late in 2015, which, too, could have pulled some sales forward from the early months of 2016. This has, however, been denied by the company,” he tells FOCUS.

Craig Uren, chief operating officer of Isuzu Truck South Africa, says that there’s nothing sinister or surprising at play. “In the previous two downturns – 2001 and 2009 – the MCV sector was also the hardest hit. This sector of the commercial market is sensitive to price and economics.

“A lot of the customers are not major fleets, and they struggle to get finance. In these circumstances, banks always run when the small guys need them; they are risk averse. These smaller companies are under pressure to survive so they stop buying; it’s not rocket science,” he reveals.

Leslie Long, senior manager: marketing and demand planning at Hino SA, paints an identical picture. “The reason for the decline in the MCV sector can be described in a single word: economy. The market is down, not only because of the South African economy, but also because of the world economy.

“MCV sales are hit hardest because of the high percentage of smaller fleets and owner-drivers. Customers are either postponing purchases, or failing to obtain finance as banks are tightening up on approval criteria,” he agrees.

Stanley Anderson, marketing director of Hyundai Automotive South Africa, agrees that the downturn in the economy is a major factor when it comes to the MCV sector’s woes. “The economy is in a downturn; there is less economic activity and there are fewer requirements for MCVs,” he tells FOCUS.

However, he says two other factors are also coming into play. “There were price increases in the first quarter of 2016, which impacted on sales (there were very few increases last year). Also, there is a lot of uncertainty as the elections draw near, and this has caused customers to extend their replacement cycles,” Anderson maintains.

Like Anderson, Jaco Steenekamp, general manager: sales and marketing at Volkswagen Commercial Vehicles, says that the downturn in the MCV market isn’t only due to the economy. “The decline of the MCV sales in April can be attributed to the down buying from 22-seaters to 16-seaters, due to the problems with the issuing of driving permits for the 22-seaters,” he says.

Like Anderson, Jaco Steenekamp, general manager: sales and marketing at Volkswagen Commercial Vehicles, says that the downturn in the MCV market isn’t only due to the economy. “The decline of the MCV sales in April can be attributed to the down buying from 22-seaters to 16-seaters, due to the problems with the issuing of driving permits for the 22-seaters,” he says.

So, that’s the current situation. Are things likely to improve? Isuzu’s Uren says the MCV market will bounce back – in time. Hino’s Long says that this won’t be any time soon.

“I don’t see any miraculous recovery in the short to medium term. We have seen a very negative outlook from both Mike Schussler and PSG when it comes to the world economy. Business and consumer confidence, in both South Africa and worldwide, is very low with very few indicators showing signs of recovery. In fact, we have revised our outlook on the total truck market from 28 000 to 25 000,” he tells FOCUS.

This doesn’t mean that the Hino team is not still reasonably upbeat. “We couldn’t have hoped for a more positive start to 2016, particularly as we have not introduced any new products during this period,” explains Ernie Trautmann, vice president of Hino SA.

While he’s obviously mindful of current market conditions, Trautmann is not going to let this drag him down. “We are very aware that we are currently operating in a very tough market and have to ensure we continue to build on relationships with all our customers, both old and new, as we face a year of falling sales and rising costs,” he says.

Hino wants to be the top-selling truck brand in South Africa by 2020. “As such, the objective for Hino and its dealers is to stay positive this year, which has started in an environment of doom and gloom,” he tells FOCUS.

Uren is adopting an equally pragmatic and positive approach. “The industry has been through declines in 2001 and 2009 and the strategies we applied then are no different to what we require today to keep our business on track and even to grow. Success comes with being able to analyse the problems and institute growth and development strategies, without pressing the proverbial panic button,” he says.

There you have it. The MCV market has the flu, which can cause some misery, but, just like the

flu, this, too, will pass. No one needs to panic – just yet.

Published by

Focus on Transport

focusmagsa