Down but not out

The local commercial vehicle market has softened slightly in the last three months, writes FRANK BEETON, but volume retention over the first quarter of the year is encouraging.

The South African truck market has returned cumulative year-to-date growth of 2,8 percent for the January-September 2012 period, when compared to the result for the equivalent first three-quarters of 2011. However, in the quarter-on-quarter comparison between the most recently completed quarter and the immediately preceding April-June 2012 period, the overall market reduced in terms of absolute volume by slightly more than two percent. It had been noted that monthly market volumes during August and September were, on average, 200 units less than those recorded during the May-July period, for reasons explained below.

The recent softening in commercial vehicle sales activity can be ascribed to factors that include reduced local business confidence, as illustrated by the published short-term outlook of October’s Kagiso Purchasing Managers’ Index (PMI), and growing concerns over rand foreign exchange and oil price volatility. This situation has been brought about by the unresolved labour unrest in the local mining sector (at the time of writing) and its possible spread to other areas of business, the recently completed truck drivers’ strike, continuing concern over the European sovereign debt crisis, and reduced growth prospects for developing economies.

As reported in our review of the preceding quarter, Mercedes-Benz South Africa remains constrained by its overseas principals to reporting only aggregated monthly sales data for its Mercedes-Benz, Freightliner and FUSO brands to Naamsa. In turn, Naamsa has estimated the breakdown of these aggregated sales to individual model and variant levels. The following analysis has processed the resulting data on the assumption that it is the most accurate reflection of the true market composition available at this point. Readers should please bear this situation in mind when comparing this analysis and its conclusions with previous articles in FOCUS on Transport and Logistics’ series of market reviews.

SEGMENTATION DYNAMICS

In terms of market segmentation, the third quarter has witnessed a continuing recovery in the market share performance of the cruiserweight HCV category, resulting from improved supply of Japanese-sourced commercial vehicle products which were previously restricted by the after-effects of March 2011’s tsunami and earthquake events in that country. The third quarter penetration of 18,4 percent achieved by this segment, which consists mainly of the heavier 4×2 units employed in the distribution sector, was still slightly off its traditional level of around 20 percent of the total market, but there have been suggestions, as reported in our review of the second quarter, that some operators have been migrating out of this segment to the lower reaches of the EHCV category, with an increasing number of multi-axled rigid units witnessed on urban delivery duties, and also into the top end of the MCV segment, where payloads of around five tonnes can be accommodated at a lower initial cost than in the case of the lightest HCV products.

The premium payload EHCV segment retained its leadership of the overall market during the third quarter, when its penetration level of 45,7 percent was unchanged from its previous quarter performance. Despite evidence of increased utilisation of the Durban-Johannesburg petroleum pipeline, and the transfer by local manufacturing plants of some vehicle transportation tasks to rail, this segment has held firm, supported by the increased use of EHCV models in the distribution sector, as noted above. The entry-level MCV segment recorded a slight increase in penetration to 32,9 percent, from 32,3 percent in the previous quarter, while the heavy bus category reduced to three percent market share from 4,3 percent in the second quarter. This latter reduction reflected the completion, during July, of deliveries against the substantial Ethekwini Municipality contract for 124 Mercedes-Benz and Scania city buses. Interestingly, the market share performances recorded by the four constituent segments during the third quarter of 2012, as noted above, were remarkably similar to the equivalent ratios returned by these categories for the whole of 2011, when the MCV grouping captured 44,7 percent, HCV took 17,9 percent, EHCV accounted for 44,7 percent and buses came in at 3,7 percent of the total market. This suggests a surprising degree of stability in the current structure of the market, despite the plethora of influencing factors that have recently been at play in both the local and global macro-economic scenarios.

MANUFACTURER PERFORMANCE

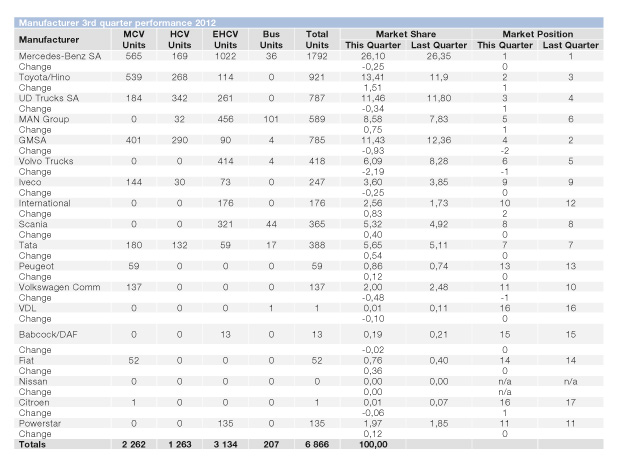

The chart illustrates the relative market performance and ranking of each participating manufacturer in the quarter just completed, as compared to the returns for the immediately equivalent preceding period.

Readers should note the groupings of manufacturers contained in this section of the report. The rule employed is that if a manufacturer/group sells more than one brand through its distribution channels, then all sales for those brands will be consolidated in the result for the manufacturer/group. Thus, Mercedes-Benz includes Freightliner and FUSO, Toyota/Hino contains both brands, MAN includes Volkswagen (Constellation) trucks and Volksbus passenger units, but not VW commercial vans (listed separately), and Volvo Trucks includes Mack and Renault, but not UD Trucks.

Mercedes-Benz SA

The Mercedes-Benz Group retained its traditional position at the head of the manufacturer rankings during the third quarter of 2012, albeit with a three percent reduction in volume, and quarter percent reduction in market share when compared to its second quarter performance. The Group headed the overall listings in both the MCV and EHCV segments, while Mitsubishi FUSO made the most significant Daimler Group contribution to the Japanese marque-dominated HCV category. In the total market, the share of the individual Mercedes-Benz brand fell by a margin of 0,2 percent to 17,8 percent, while Freightliner, concentrated entirely in the EHCV segment, improved to just below five percent, and FUSO declined by 0,2 percent to 3,3 percent. Major promotional activities during the quarter included a “track day” for Mercedes-Benz buses at Kyalami, the announcement of a full model change for the EHCV FUSO FV Series, and the local roll-out of the “TruckStore” used commercial vehicle franchise.

Hino/Toyota

Hino Trucks staged a spectacular comeback during the past quarter, improving its volume sales performance by 10,4 percent compared to its disappointing second quarter outcome, picking up

1,5 percent in market share in the process, and, probably even more important to its Toyota SA parent, regaining its long-running second position in the market. The recent announcement of an extended three-year, unlimited distance warranty for on-road 700 Series EHCV models marked an important step in efforts to improve the brand’s sales performance at the top end of the market, and also supporting Hino’s global objective of 196 000 unit sales in 2014/15.

UD Trucks SA

Despite suffering a 4,8 percent reduction in sales volumes and 0,3 percent loss of market share in the  quarter-on-quarter market comparison, UD Trucks moved back into its customary third market ranking during the quarter just completed. The brand also maintained its overall leadership position in the distribution heavy HCV segment, and remained the clear leader among Japanese-source manufacturers competing in the EHCV category. Recent management changes at UD Trucks Southern Africa have seen the company move under the “back office” control of the Volvo Group, although brand autonomy in customer-facing areas is said to continue.

quarter-on-quarter market comparison, UD Trucks moved back into its customary third market ranking during the quarter just completed. The brand also maintained its overall leadership position in the distribution heavy HCV segment, and remained the clear leader among Japanese-source manufacturers competing in the EHCV category. Recent management changes at UD Trucks Southern Africa have seen the company move under the “back office” control of the Volvo Group, although brand autonomy in customer-facing areas is said to continue.

Tata

Tata appears to have consolidated its position in the SA market, with its third quarter performance being slightly improved on the April-June outcome. The brand maintained its seventh position ranking during the July-September period, while improving its market share by half-a-percentage point to 5,7 percent. MCV and HCV volumes contributed to the 8,4 percent quarter-on-quarter volume improvement, while EHCV and bus sales were slightly off their second quarter levels. Recent corporate advertising has concentrated on value propositions for Tata’s MCV and HCV models and an upcoming addition to the LCV range, while there has been little news, at this stage, of the more modern EHCV truck models previewed at last year’s JIMS show.

* Tata has advised that its Prima World Truck should be launched locally within the next few months – Ed.

MAN Group

The MAN Group, including Volkswagen’s Constellation and Volksbus models, returned an improved performance during the most recent three months, and enjoyed an elevation to fifth position in the local market rankings at the expense of Volvo Trucks. MAN Group third quarter sales volumes were up by 7,3 percent, and overall market share improved by 0,75 percent to finish at 8,6 percent. The VW bus models have recently made a significant contribution to the Group, consolidating its customary position at the top of the local heavy passenger market segment. However, VW trucks have achieved only minor success in the cruiserweight HCV segment, where their specification levels and price positioning suggest considerable potential. However, this could be realised when MAN Group engines are used to replace the current MWM power units. The major promotional event for MAN during the past quarter was the widely-publicised country-wide EfficientLine tour, in which a convoy of five vehicles demonstrated the fuel consumption benefits of the latest Group technology.

GMSA (Isuzu)

Following its stellar performance in the second quarter, Isuzu Trucks South Africa, as the sole representative of the General Motors “family” in this market, slipped back two places to fourth position during the July-September timescale. This was the result of a 9,4 percent reduction in reported volume, and almost one percentage point loss in market share, finally ending at 11,4 percent. With its completely renewed product range now essentially complete, Isuzu has been concentrating on promoting the virtues of the AMT transmission and double-cab model variants in its N- and F-Series line-ups.

Volvo Trucks

Volvo Trucks, including Renault in South Africa, also lost ground during the third quarter, giving up almost 28 percent in volume, and 2,2 percent in market share, when compared to the group’s April-June outcome, and being placed one position lower in the market in sixth spot. Publicity surrounding recent management changes in the group’s South African operation has resulted in greater clarity regarding the local organisation of its brands, and it has now become evident that much of the infrastructure supporting Volvo, Renault and UD’s efforts in the South African marketplace is to be rationalised. There is no indication, at this stage, that multi-franchised dealer outlets are to be part of this plan, but the leveraging of UD’s distribution network and vehicle parc, which has been built up over the past 50 years, to the broader benefit of the group must be a tempting prospect. Renault has continued to promote its products in the past two years through a series of hands-on Construction Days, while the introduction of Volvo’s new FH Series flagship at the recent Hanover show has enjoyed wide publicity in the local trade press. This model is reportedly due for local launch during 2013.

Scania

Scania, which, through the deployment of its management, has now taken a leading position in the management of Volkswagen’s global commercial vehicle business, enjoyed a successful third quarter in the South African market, gaining 5,8 percent in delivered volume, and 0,4 market penetration points, while retaining eighth spot in the rankings. The recent changing of the guard in local management has been accompanied by assurances that there are no plans to alter the fundamentals in the structural arrangements, although increased activity in the fleet segment is envisaged. Scania’s main recent promotional activities have been centred on the co-sponsorship of driving competitions, in support of road safety.

Iveco

This Fiat Group manufacturer lost some ground in terms of sales volume and market share during the third quarter, with 8,5 percent fewer sales, and a 0,25 percent reduction in penetration, compared to its second quarter result. However, ninth position in the market rankings was retained, and it was noted that Iveco’s MCV sales held firm, while HCV sales almost doubled in the quarter-on-quarter comparison. The latter factor was particularly noteworthy as this cruiserweight category has been a segment of the South African market where Iveco has historically struggled to find traction. It was also noted that no sales of heavy buses were reported by Iveco during any of the last three quarters, suggesting that main customer PUTCO had been absent from the market since the beginning of 2012.

NC² – International Trucks

International’s fortunes underwent a substantial revival during the July-September period, with a  volume increase of 45,5 percent, improvement in market share of 0,8 percent, and promotion by two positions to occupy 10th spot in the market rankings. There has not been any evidence, as yet, of this supplier’s migration into the lower reaches of the market, as suggested by the appearance of the MetroStar product range at last year’s JIMS motor show.

volume increase of 45,5 percent, improvement in market share of 0,8 percent, and promotion by two positions to occupy 10th spot in the market rankings. There has not been any evidence, as yet, of this supplier’s migration into the lower reaches of the market, as suggested by the appearance of the MetroStar product range at last year’s JIMS motor show.

Powerstar

Powerstar’s revised VX range of construction trucks has now made its entry into the local market, and this has supported an improved quarter-on-quarter performance by the brand during the third quarter. The returns included a 3,9 percent improvement in quarter-on-quarter volume, accompanied by 0,1 percent increase in market share, although 11th position was retained in the rankings. Preparations for the launch of the all-new V3 model, aimed at securing a foothold in the line-haul market, are proceeding.

Babcock/DAF

DAF’s performance in the local market continued to disappoint during the third quarter, when only 13 units were delivered. This was, however, enough to sustain 15th position in the market rankings, despite a loss of 0,1 percentage points in market share in comparison to the brand’s second quarter result.

VDL

Bus chassis specialist manufacturer VDL delivered just one unit during the third quarter, to record a market share of 0,01 percent, and placing the brand 16th, and joint last, in the market rankings.

Van manufacturers

Four vehicle manufacturers continue to compete in the MCV segment of this market only with European-sourced integral van-derived products. Of these, Volkswagen Commercials, selling its Crafter  line-up in the local market, suffered a volume loss of 21,3 percent during the third quarter, coupled to a 0,5 percent reduction in market share, and fell to 11th spot in the rankings. Thirteenth-placed Peugeot and 14th-placed Fiat both carried over their rankings from the second quarter, but enjoyed a more successful July-September period in terms of units sold and market penetration. Peugeot increased its market share by a margin of 0,1 percentage points to 0,9 percent, and Fiat improved by 0,4 percentage points to finish with 0,8 percent. Citroen, on the other hand, reported only one unit delivered during the quarter, to place 16th, and equal last, in the market rankings.

line-up in the local market, suffered a volume loss of 21,3 percent during the third quarter, coupled to a 0,5 percent reduction in market share, and fell to 11th spot in the rankings. Thirteenth-placed Peugeot and 14th-placed Fiat both carried over their rankings from the second quarter, but enjoyed a more successful July-September period in terms of units sold and market penetration. Peugeot increased its market share by a margin of 0,1 percentage points to 0,9 percent, and Fiat improved by 0,4 percentage points to finish with 0,8 percent. Citroen, on the other hand, reported only one unit delivered during the quarter, to place 16th, and equal last, in the market rankings.

Non-reporting manufacturers

Readers should please note that local sales volumes of several commercial vehicle brands, including FAW, JMC, Dongfeng, Foton and Ashok Leyland, are not yet reported to Naamsa and are therefore excluded from the comments and data contained in this report. During the review period, FAW launched its J6 line-haul truck-tractor into the local market, while Dongfeng added the T-Lift 6×4 tipper chassis to its line-up. It should also be noted that Associated Motor Holdings (AMH) has recorded aggregated total sales in the MCV segment during the review period. It has been reported that the earlier policy of that group, in which no details of the individual models sold have been disclosed to Naamsa, has now been reversed to one of full disclosure. If this proves to be correct, Hyundai HD Series light truck volumes will be included in the Chart 1 database of this review from the beginning of 2013. In the meantime, AMH’s total reported sales in the MCV segment during the third quarter of 2012 totaled 146 units.

GENERAL MARKET COMMENTS

With continuing concerns over labour, rand exchange rates, and fuel pricing, it can be expected that a generally conservative approach will be adopted by transport operators to their acquisition activities up to the end of the current year. However, it has been encouraging that the volumes maintained by the market through the initial three-quarters of the present year have been slightly better than that recorded last year, and a modest degree of year-on-year growth still seems the most likely outcome at the end of December. The longer term outlook remains more positive, with the “Expected Business Conditions” element of the September Kagiso PMI showing a reading of 55,5 – which predicts an improvement in the local manufacturing environment six months from now. This is clearly based on an expectation of more normality in the local business environment, following the settlement of current wage negotiations, and the emergence of a more favourable political scenario after the year-end ANC conference in Mangaung.

Over the longer term, prospects for the market are expected to remain positive as the South African Government rolls out its infrastructural investment programmes, and local interest rates are at their lowest level in 38 years. It is, however, important to recognise that government has a well-documented preference for increased emphasis on rail transport. This has been reflected in the purchase of new locomotives by Transnet, and the initiation of the process to buy large quantities of additional motive units and rolling stock. While this is not likely to impact significantly on the truck market in the short term, it could influence its future shape when the various transport modes are called upon to integrate their service delivery. In our view, it is expected that this process will be heavily dependent on public-private partnerships, which will provide ample opportunities for the road transport industry to influence its own longer term destiny.

Published by

Focus on Transport

focusmagsa

!

From 1 Apri

!

From 1 Apri

Big news from FOCUS on Transport + Logist

Big news from FOCUS on Transport + Logist

FUSO: Driving the Future of Mobile Healthc

FUSO: Driving the Future of Mobile Healthc

A brand

A brand

Wondering about the maximum legal load for a

Wondering about the maximum legal load for a

The MAN hTGX powered by a hydrogen combus

The MAN hTGX powered by a hydrogen combus

Exciting News for South African Operators

Exciting News for South African Operators