EHCVs and buses to the rescue in 2014

FRANK BEETON reflects on the fourth quarter, and full year, of 2014

It was noted, with considerable regret, that Mercedes-Benz South Africa recommenced the practice of reporting only aggregated monthly sales data for its Mercedes-Benz, Freightliner and Fuso commercial vehicle brands to the national Department of Trade and Industry (dti) during the fourth quarter of 2014. This practice of limited disclosure had been previously abandoned by the company in March 2013, and its resumption is presumably a result of a directive from its overseas principals.

Given the acknowledged importance of vehicle sales statistics in monitoring the state of health of the national economy, this decision, by a major player in the commercial vehicle market, to withhold detailed sales reporting cannot be welcomed, as any deterioration in the quality of this data will, inevitably, compromise the ability of both public and private sector organisations to plan for the future.

Unfortunately, the company withholding this data is a major participant in all four segments of the commercial vehicle market, and the absence of its detailed inputs will seriously impair the value of detailed trend analyses in the total market and its individual segments.

We trust that efforts to resolve this situation will bear early fruit. In the meantime, the National Association of Automobile Manufacturers of South Africa (Naamsa) has estimated the breakdown of these aggregated sales to individual model and variant levels.

The following analysis has processed the resulting data on the assumption that it is the most accurate reflection of the true market composition currently available. Readers should please bear this situation in mind when comparing this analysis and its conclusions with previous articles in FOCUS’s series of market reviews.

TRUCK MARKET RESULTS

The final outcome for the South African truck market in the 2014 calendar year, as reported by Naamsa and subject to the circumstances described above, was a total of 31 551 units sold.

This was the fourth highest total recorded in the history of the market, having only been exceeded by the 2006, 2007 and 2008 volumes, and it improved on the 30 924 unit volume recorded in 2013 by a margin of

2,03 percent.

The market finished 2014 strongly, with the total volume of 2 572 trucks, buses and vans reported during the month of December, 2014, improving on the corresponding result recorded in December, 2013, by 10,5 percent.

This reflected a concentrated effort by several prominent suppliers to maximise vehicle deliveries before the end of the year. In the comparison of the estimated individual segment performances for 2014, against their equivalent 2013 outcomes, only the entry-level medium commercial vehicle (MCV) segment deteriorated significantly – ending 2014 some 4,9 percent off its previous year result. In absolute terms, the cruiserweight heavy commercial vehicle (HCV) segment ended only three units short of its 2013 outcome, but the premium payload extra-heavy commercial vehicle (EHCV) and bus segments each returned substantial year-on-year volume improvements over the full 12-month period, to the tune of eight and 19,8 percent, respectively.

It was pleasing to note that the market, despite some fairly serious environmental challenges during the past 12 months, ended 2014 with a measure of positive growth, which was better than the expectations of a flat year-end outcome that were widely held in the supply industry mid-way through the year.

At that time, a combination of unresolved and widespread industrial action, escalating fuel prices and two interest rate hikes had undermined confidence in earlier consensus industry expectations of two to 3,5 percent year-on-year growth.

It must be recognised, however, that the main engine behind this growth has been the outstanding performance of the EHCV segment, which has been driven largely by commercial activities across South Africa and outside of its borders, as well as a change in the acquisition policies of major operators to shorten their replacement cycles.

SEGMENTATION DYNAMICS

The premium payload EHCV segment has maintained its position as the market leader during the fourth quarter of 2014, albeit with a slightly reduced penetration level of 40,5 percent, compared to the 45 percent recorded in the preceding quarter.

The entry-level MCV segment gained some market share as a result of the recovery in local trading conditions following the termination of lengthy strike actions in the mining and manufacturing sectors. It posted a penetration of 36,7 percent in the fourth quarter; up from the 33,6 percent level occupied in the previous review period.

Similar macro-economic influences supported a substantial market share recovery by the cruiserweight HCV segment, which elevated its position from 17,4 percent in the third quarter to 18,6 percent in the quarter just completed.

The passenger bus segment, at 4,3 percent total market penetration in the final three-month period, has continued to benefit from deliveries of vehicles to several bus rapid transit (BRT) networks, and has been on a gentle, but persistent, upward trend, in terms of market share, since the beginning of 2014.

We have noted that the market share positions occupied by the three goods-vehicle segments at the end of 2014 were remarkably similar to those held one year earlier. This seems to indicate that the displacements that took place during the year (elevation of the EHCV segment, and depression of the MCV and HCV segments) were the result of external influences rather than any significant change in the purchasing habits of South African operators.

Once conditions in the domestic economy had stabilised, established buying patterns quickly re-emerged. This could be an important consideration to be borne in mind when planning marketing strategies going forward.

The fourth quarter review of application performance levels within the MCV segment has freight carriers at 63 percent, integral vans at 31,6 percent, buses at 1,9 percent and tippers at 3,5 percent. This reflects a slight weakening of the freight carrier share, down from 67,2 percent in the third quarter, and a slight increase, from 29,9 percent, for integral vans.

Research, carried out during 2014 in the MCV universe, revealed that an inordinately high percentage of integral vans (estimated at some 60 to 80 percent of total sales), are being converted in the aftermarket for passenger-carrying (midibus-taxi) duties. This argues against the notion that integral vans and freight carrier chassis/cabs are in competition for the same end-user market. It suggests rather that the shifts in this set of market share dynamics are a reflection of broader influences acting on the differing vehicle types, rather than any fluctuations in operator preferences at the lower end of the freight transport spectrum.

We are still faced with the less than perfect market reporting caused by the unreported aftermarket conversion of integral van units into ambulances and midibuses, and freight carrier chassis/cab units being bodied as tippers, or commuter buses. These conversions are not currently reflected in the Naamsa statistics.

MANUFACTURER PERFORMANCE

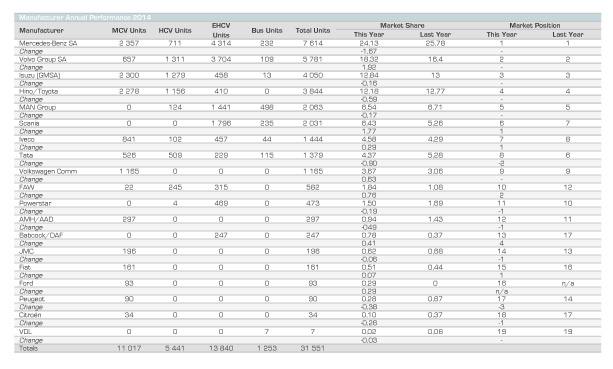

The accompanying chart illustrates the relative market performance and ranking of each participating manufacturer in the year just completed, as compared to the returns for the immediately preceding year.

The groupings contained in this section of the report are based on the rule that if a manufacturer/group sells more than one brand through its distribution channels, then all sales for those brands will be consolidated in the result for the manufacturer/group.

Thus, Mercedes-Benz includes Freightliner and Fuso. Toyota/Hino contains both brands. MAN includes Volkswagen (Constellation) trucks and Volksbus passenger units, but not VW commercial vans (listed separately), while Volvo Trucks includes Volvo Buses, UD Trucks and Renault Trucks.

Please note that, owing to Naamsa’s estimation of Mercedes-Benz, Freightliner and Fuso sales and the resulting total market and individual segment volumes, we have not commented on supplier market shares, as these are factually unknown. The market shares listed in the chart are, therefore, not necessarily accurate, and are included only for continuity. Our comments below will, therefore, concentrate only on absolute sales volumes and overall market positions for each individual supplier.

Mercedes-Benz SA

For reasons now explained, we can only report that the Mercedes-Benz family probably retained its overall leadership position in the market during 2014, with an estimated reduction of 4,5 percent in the volume of units delivered when compared to the 2013 outcome. It is also not possible to comment accurately on the individual performances of the constituent Mercedes-Benz, Freightliner and Fuso brands.

The most important product event that took place during the fourth quarter of 2014, was the launch of new generation Fuso Canter LIFT range with its pioneering Duonic dual-clutch gearbox; claimed to be the first truck application of such a transmission to arrive in South Africa. The latest Canter line-up also introduces new crew-cab configuration to the range (see FOCUS October 2014).

Volvo Group Southern Africa

The Volvo Group Southern Africa occupied its now customary runner-up market position during 2014, with an improvement of 14 percent in the absolute total of units delivered when compared to its 2013 outcome.

The group also held on to leadership of the HCV segment through the efforts of constituent member UD Trucks, and recorded a 21 percent gain in EHCV deliveries; mainly due to excellent early marketplace acceptance of newly introduced Volvo premium truck models.

Renault Trucks launched its striking new K and C-ranges of construction specialist trucks during the fourth quarter, while UD Trucks reported the production run-out of its U41 MCV line-up in October.

There has still been no firm announcement regarding the launch timing of the successor entry-level product, expected sometime during 2015, and the temporary absence of a presence in the MCV segment is likely to soften the Group’s overall market performance until this event takes place.

UD will also launch its Thai-sourced Quester “emerging markets” EHCV range during the first quarter, further progressing the Group’s evolving strategy to reposition its constituent brands for less internecine overlap in the local market.

The Volvo Group is building a rationalised regional parts distribution centre in Johannesburg; part of its policy of rationalising back office functions across the family.

Isuzu Truck SA (GMSA)

The intense battle between Isuzu Truck SA and Hino/Toyota for occupation of third spot in the supplier rankings continued throughout 2014, with the former emerging victorious at the end of the year, thanks to a 0,8 percent margin of improvement, in the number of vehicles delivered, in comparison with the previous year’s outcome. This increase was spread evenly over all market segments, with the exception of the EHCV category, where Isuzu delivered nine percent fewer vehicles than in 2013.

The intense battle between Isuzu Truck SA and Hino/Toyota for occupation of third spot in the supplier rankings continued throughout 2014, with the former emerging victorious at the end of the year, thanks to a 0,8 percent margin of improvement, in the number of vehicles delivered, in comparison with the previous year’s outcome. This increase was spread evenly over all market segments, with the exception of the EHCV category, where Isuzu delivered nine percent fewer vehicles than in 2013.

Isuzu has built its recent run of success on the exploitation of important market niches, but recent product introductions by direct competitors should increase the level of competition in a number of these areas during 2015.

Hino/Toyota

Toyota SA’s truck specialist division delivered 2,6 percent fewer units in 2014 than had been the case in the smaller total truck market one year earlier, but retained fourth position in the overall ranking of suppliers. During the year, third position in the rankings was achieved in two quarters out of four, while a considerably improved EHCV segment volume performance of 410 units was recorded.

This latter outcome provides a firm base for the stated objective of the new management team to improve performance in this segment going forward. Other goals include raising the annual volume target to 4 000 units; some four percent above the 3 844 unit final total registered in 2014. New dealer premises were also opened in Tshwane during the fourth quarter of 2014.

MAN Group

The MAN Group’s 2014 sales volume ended 0,6 percent off its equivalent 2013 performance, resulting in a retained fifth position in the market standings. The group has re-established some level of dominance in the local bus segment, with 2014 deliveries of just less than 500 units, including continuing supply of 120 Lion’s City A84 buses ordered by Tshwane Bus Services, and the handing over of 12 new Performance Based Standards-compliant 172-passenger HB3 bi-articulated buses to Buscor.

One of the major challenges facing the Group’s recently reconstituted local management team will be to breathe some new life into the Brazilian-sourced Volkswagen Constellation range, which continued to disappoint in 2014 with 40 percent fewer sales than those recorded one year earlier, and very little presence in the cruiserweight HCV segment.

Scania

Scania experienced a highly successful year in 2014. It delivered nearly 25 percent more vehicles than in 2013, and was promoted from seventh to sixth position in the market listings. This improvement in performance was reflected in both the EHCV and bus segments, where Scania currently conducts all of its South African business.

Recent features of its local marketing model include an in-house financing facility, extensive driver training, a fleet of used trucks available for rental operation, and a free fleet-management solution with every vehicle sold. Scania has continued its efforts to promote alternative fuel usage in passenger transport, and recently sold ten CNG-fuelled K280 buses to Unitrans Passenger.

Iveco

Much publicity has recently surrounded the opening of Iveco’s $US 70 million (R814,5 million) Rosslyn truck and bus assembly facility, which is operated in partnership with the Larimar Group, and the concurrent launch of new Eurocargo series cruiserweight trucks, including 4×4 models. Appropriately, this was accompanied by a year-on-year market ranking improvement from eighth to seventh position, on the back of a 8,8 percent gain in absolute vehicle deliveries.

It was noted that increased visibility for the parent CNH Industrial organisation was a feature of publicity surrounding the events described above, as was the appointment of Eamonn Parker as managing director of the local Iveco operation.

Tata

Tata’s 2014 outcome included a reduction of 15,6 percent in the absolute number of vehicle deliveries, and demotion from sixth to eighth position in the overall ranking of suppliers. The bright spot in this Indian manufacturer’s performance during the year was a 5,5 percent improvement in bus deliveries, leading to confirmation that it is now a significant participant in the passenger vehicle segment.

FAW

Chinese manufacturer FAW, having inaugurated its Coega assembly facility early in the third quarter, recorded an impressive 74 percent improvement in sales volume in 2014 over its 2013 performance level. In the process, the company earned promotion from twelfth to tenth position in the market rankings. The year-on-year volume improvement was spread across all three goods vehicle market segments, and was particularly notable for the 245 units reported in the cruiserweight HCV category.

Powerstar

Powerstar’s 2014 outcome, in comparison with one year earlier, included a 9,4 percent reduction in absolute deliveries, and demotion from tenth to eleventh position in the supplier standings. Notably, this brand has now established a regular presence in the cruiserweight HCV segment of the market in addition to its regular participation in the EHCV category.

Powerstar’s 2014 outcome, in comparison with one year earlier, included a 9,4 percent reduction in absolute deliveries, and demotion from tenth to eleventh position in the supplier standings. Notably, this brand has now established a regular presence in the cruiserweight HCV segment of the market in addition to its regular participation in the EHCV category.

During the fourth quarter, a restructuring of the holding company, Ever Star Industries, was announced, along with the reintroduction of the Shaanxi-sourced Powerland truck range and other construction-related products.

AMH/AAD

Despite the well-publicised opening of its Apex commercial vehicle assembly facility during the third quarter, the Imperial Group’s truck operation, which currently handles Hyundai’s MCV truck line-up, lost considerable ground in 2014. It recorded 32,8 percent fewer unit sales than the year before, together with a loss of one position in the market standings, to finish in twelfth place. Future plans for the local plant include an increased level of local content inclusion and the export of 20 percent of its output to Botswana and Namibia.

Babcock/DAF

Babcock/DAF’s reported 2014 sales deliveries of 247 trucks – an improvement on the equivalent situation in 2013 of no less than 115 percent. This resulted in a quantum leap up the market rankings for this supplier from seventeenth to thirteenth position. Part of this success could be ascribed to an order for 133 XF105.460 truck tractors placed by Ngululu Bulk Carriers, reported to be the largest South African order received by the organisation to date.

JMC

JMC’s market participation is currently restricted to the MCV segment, and its reported volume of deliveries fell off slightly in 2014, by a measure of 7,1 percent, when compared to its 2013 result. This was accompanied by demotion from thirteenth to fourteenth position in the overall ranking of suppliers.

VDL

Developments at bus chassis specialist supplier VDL during 2014 included a management reorganisation prompted by the departure of well-known industry personality Sam Mansingh. The total sales of only seven units reported during the year just completed was less than half of the 19-unit total recorded one year earlier. This resulted in the retention of nineteenth and last position, in the overall market order of merit.

European van manufacturers

Five vehicle manufacturers compete in the MCV segment of this market with European-sourced integral vans and their derivatives; these being Volkswagen Commercials, Ford, Peugeot, Citroën and Fiat.

Ford has only recently returned to the MCV segment of this market. The company began reporting its Transit/Tourneo family of vans and people movers from the third quarter of 2014, and had moved into sixteenth position in the rankings by year’s end.

Of the others, ninth-placed Volkswagen and fifteenth-placed Fiat recorded year-on-year sales growth in 2014 (to the tune of 23 percent and 19 percent respectively), while the related seventeenth-placed Peugeot and eighteenth-placed Citroën brands suffered volume reductions of 56,5 percent and 70,4 percent respectively. It was noted that Citroën did not report any sales in this category during the fourth quarter.

Non-reporting manufacturers

Readers should note that local sales volumes of several commercial vehicle brands, including Dongfeng, Yutong, Foton and Ashok Leyland, are not yet reported to Naamsa, and are, therefore, excluded from the comments and data contained in this report.

GENERAL MARKET COMMENTS

In a recent review of the exchange rate trends of important truck-sourcing foreign currencies versus the rand, it was noted that the movements of the United States dollar, euro and Chinese yuan followed broadly similar patterns, but those of the Brazilian real and Japanese yen have taken radically different routes.

Using a common base value of 100 for all the exchange rates prevailing on the first day of 2013, the positions of the first three currencies were at levels of 128, 122 and 131, respectively, on November 5, 2014, whereas the real and yen were positioned at 106 and 94 respectively on the same date.

Should this situation persist, it is likely to have quite a significant impact on the comparative local prices of vehicles, components and parts sourced from these important manufacturing world areas.

On November 23, 2014, the dti published the approved version of its Programme Guidelines for the Medium and Heavy Commercial Vehicles Automotive Investment Scheme. This differs materially from the original document published on July 1, 2014, in that local assembly of truck cabs will become a non-negotiable qualifier for participation in the scheme from April 1, 2016. It also includes a provision allowing bus and truck body manufacturers to access incentives, provided that they form part of the supply chain linked to medium and/or heavy commercial vehicle original equipment manufacturers.

The introduction of the cab assembly qualifier is not likely to materially influence the position of manufacturers already active in the South African market, who have decided, on economic grounds, to import their cabs in built-up and finished condition.

On the other hand, the inclusion of the bodybuilding fraternity into the programme presents as a positive move, in that local manufacture of relatively simple bodywork makes more commercial sense than re-inventing the upstream base vehicle production and assembly process.

We understand that discussions on this matter between the commercial vehicle supply industry and the dti are continuing, presumably because it does not appear that the programme, even in its updated form, will have much influence on established South African vehicle manufacturers, importers or their suppliers.

There can be no doubt that the recent declining trend in local fuel prices, which are now at levels similar to those prevailing some two-and-a-half years ago, has been enormously beneficial to the road transport industry. Fuel makes up a major proportion of truck running costs, particularly for operators involved in long-distance high-utilisation applications, and the recently announced reductions in the regulated wholesale price of diesel are sure to be reflected in improved bottom lines for operators of all sizes.

The recent decline in global crude oil prices, despite some rand weakness, has worked in South Africa’s favour, and promises to mitigate inflationary trends in the local economy, with resulting interest rate stability, for some time to come.

While serious challenges in the power supply area and labour relations environment are still a prospect, and their impacts on the local economy difficult to predict, the consensus industry forecast of 4,6 percent growth for the 2015 truck market, to an absolute level of around 33 000 units, appears achievable at this early stage of the year.

QUARTERLY REVIEW

This commentary reflects the state of the South African commercial vehicle market for vehicles with gross vehicle mass (GVM) ratings above 3 500 kg, as reported to the National Association of Automobile Manufacturers of South Africa (Naamsa). In line with the current reporting regime of that organisation, the market has been divided into the following segments:

MCV – medium commercial vehicles, 3 501 to 8 500 kg GVM

HCV – heavy commercial vehicles, 8 501 to 16 500 kg GVM

EHCV – extra-heavy commercial vehicles, 16 501 kg GVM and above.

Buses – passenger vehicles, 8 501 kg GVM and above.

The review period for this commentary is the fourth Quarter of 2014 – i.e. October to December, 2014, inclusive – and also the 2014 calendar year.

These reviews are presented on a quarterly timescale, in order to reduce the impact of short-term market distortions which are often created by specific bulk-buy deliveries, the launch of new products, and/or the run-out of obsolete product ranges.

Published by

Focus on Transport

focusmagsa