Light through the darkness?

Strikes plagued the industry this last quarter, but how did that affect sales?

With the first three quarters of 2013 now recorded history, the South African truck market has grown by a year-to-date margin of 10 percent when compared to the equivalent January to September period in 2012. Although highly satisfactory, this performance was possibly compromised, to some extent, by a lengthy period of industrial action in the local motor sector.

In September, strike activity brought an end to a strong run of market growth, which had seen four individual month totals (May to August) at post-2008 record levels. This sustained period of recent record results had been achieved despite economic conditions, both locally and abroad, that were not perceived to be entirely supportive of a positive trend. The increased sales momentum was made possible by a situation of robust buyer demand being matched by adequate product availability.

However, the September result was negatively influenced by constraints on the supply side of the industry caused by the wide-ranging effects of strikes, which affected local vehicle assembly plants, component manufacturers and the downstream chain of dealers, bodybuilders, service providers and equipment suppliers to varying extents.

Notwithstanding the foregoing, the total volume of the July to September market improved by a margin of 1,9 percent over the result for the preceding quarter. This was driven by quarter-on-quarter increases by all segments, led by the bus grouping at 17,1 percent, followed by cruiserweight heavy commercial vehicles (HCVs) at 3,2 percent, the premium payload extra heavy commercial vehicle (EHCV) segment at 1,6 percent and entry-level medium commercial vehicles (MCVs) at 0,3 percent.

The reasons for the relatively strong market performance in the second and third quarters have been relatively difficult to rationalise. Reported business confidence in South Africa has been quite erratic. In some recent months it has been strong and in others somewhat benign. This is probably due to the macro-economic environment and fermenting local industrial action; the latter linked to political position-taking ahead of the 2014 general election and inter-union rivalry.

On the upside, vehicle availability had normalised after the lingering effects of the 2011 Tohoku tsunami in Japan had worked their way out of the system. The financing environment has also been positive, with local interest rates at 40-year lows and larger local businesses flush with cash, making some vehicle acquisitions possible without borrowing.

It is also possible that risk-averse operators have been shortening their fleet replacement cycles to take full advantage of deal packages that underwrite the operating costs of new vehicles for periods of up to five years. In turn, some of the displaced units that have been traded-in, or bought back by suppliers, were exported into Africa, bolstering the growing business tempo between South Africa and its neighbours north of our borders.

SEGMENTATION DYNAMICS

The market segmentation pattern remained fairly static in the transition from the second to the third quarters. The EHCV grouping held firm at 43 percent market share, while the MCV category fell marginally from 36,5 percent in the second quarter to 36 percent in the quarter just completed. The HCV segment gained slightly from 17,2 to 17,4 percent, and buses also rose from 3,1 to 3,6 percent.

With these relatively small shifts, it seems that the restrictions in vehicle availability during September did not exert any undue influence on the segmentation profile. It is also interesting that the segmentation hierarchy remained stable, in a period when the market was showing signs of steady growth, indicating no major shift in the usage pattern of vehicles as a whole.

With these relatively small shifts, it seems that the restrictions in vehicle availability during September did not exert any undue influence on the segmentation profile. It is also interesting that the segmentation hierarchy remained stable, in a period when the market was showing signs of steady growth, indicating no major shift in the usage pattern of vehicles as a whole.

There are strong indications that the bus segment, which has languished in negative growth territory thus far in 2013, is about to enter a period of greater prosperity. A number of major programmes supporting the roll-out of integrated public transport networks have recently been announced, covering 13 cities and involving planned expenditure of more than R5 billion during the 2013/14 financial year.

This will include the expansion of the ReaVaya bus rapid transport (BRT) network in Johannesburg (an order for 134 Mercedes-Benz buses is currently being delivered), and MyCiTi in Cape Town (orders placed for 40 Volvo buses). New networks are being planned in George, Buffalo City, Ekurhuleni, Mangaung, Msundusi and Polokwane, with roll-outs expected to begin in the next fiscal period.

The Tshwane Bus Service has placed an order for 120 MAN Lion’s City low-floor city buses, and Johannesburg’s Metrobus has issued tenders for up to 175 new environmentally friendly city buses. BRT systems are also being developed and planned in Durban and Rustenburg, so prospects for the heavy bus segment are looking considerably brighter over the next few years.

Finally, in the review of application performance within the entry-level MCV segment, it should be remembered that many bus units are included in the panel van grouping, while some tippers are still being lumped together with chassis-cab derived freight carriers. The reported MCV segment application penetration levels for the third quarter were: freight carriers 61,1 percent, integral vans 36,07 percent, buses 0,92 percent and tippers 1,91 percent.

MANUFACTURER PERFORMANCE

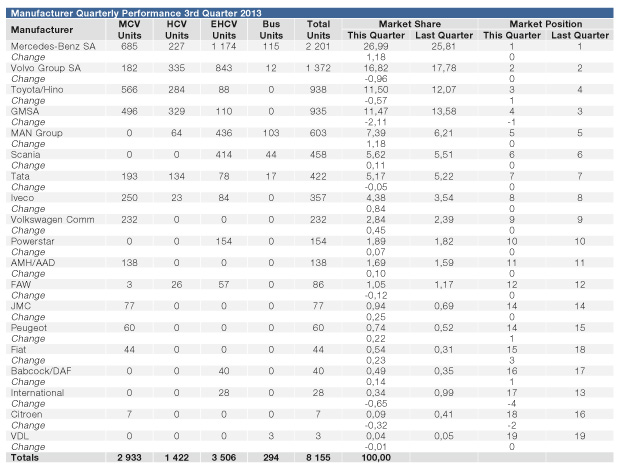

The accompanying chart illustrates the relative market performance and ranking of each participating manufacturer in the quarter just completed, as compared to the returns for the previous quarter.

The groupings contained in this section of the report are based on the rule that, if a manufacturer/group sells more than one brand through its distribution channels, all sales for those brands will be consolidated in the result for the manufacturer/group. Thus, Mercedes-Benz includes Freightliner and Fuso and Toyota/Hino contains both brands. MAN includes Volkswagen (Constellation) trucks and Volksbus passenger units, but not VW commercial vans (listed separately), while Volvo Trucks includes UD Trucks as well as Mack and Renault. This last change recognises the very visible and freely acknowledged connection that now exists in South Africa between the Volvo Group and UD Trucks SA.

Mercedes-Benz SA

The perennial market leader improved its penetration level by 1,2 percentage points in the third quarter when compared to the April to June period. This result was driven by segment-leading performances in the MCV, EHCV and bus categories, the latter reflecting initial deliveries of 134 rigid and articulated Mercedes-Benz O500 buses against orders placed for Rea Vaya Phase 1B, as mentioned earlier.

Of the individual brands contained within the Mercedes-Benz family, the parent marque achieved an overall third-quarter market penetration level of 17,6 percent, while Freightliner captured 5,2 percent and Fuso 4,1 percent of the total market.

Recent promotional activities include the advertising of the current Actros range’s low operating costs on operational lease and publicity relating to the delivery of 22 Atego trucks to the City of Tshwane’s electricity department.

Volvo Group

The Volvo-led grouping, which includes Renault and UD Trucks, has now settled firmly into second position in the overall rankings, although its third quarter market-share performance declined by nearly one percentage point when compared to the group’s April to June result.

The achievement of overall leadership of the HCV segment was entirely due to the contribution of UD products to the group aggregate. The respective market shares of Volvo, Renault and UD for the third quarter settled at 6,3, 1,2 and 9,4 percent, respectively. Significantly, NWT Rustenburg has recently been appointed as a joint Volvo/Renault/UD dealership, suggesting that a multiple brand outlet strategy could become more commonplace in the future.

All three marques participated in the Nampo Show at Bothaville in May, while the new Volvo FH, FM and FMX ranges were launched at a separate event ahead of JIMS.

Hino/Toyota

The truck specialist division of Toyota SA recaptured third position in the market rankings for the third quarter by outselling GMSA/Isuzu by the slim margin of three units! This was achieved despite a loss of 0,6 percentage points in market share in comparison to its second quarter outcome. New Hino 700 Series EHCV segment derivatives were on display at JIMS.

GMSA (Isuzu)

Isuzu Truck SA has continued to provide the entire contribution to General Motors South Africa’s participation in the market segments covered by this review. Unfortunately, Isuzu’s tenure of third position in the market rankings, that had been achieved during the second quarter, was reversed in the July to September period when it was placed fourth with a market share reduction of 2,1 percent. The margin between Isuzu and Hino was, however, extremely tight, and this battle for position is likely to be ongoing.

Isuzu Truck SA made a significant corporate announcement during the JIMS period, and this will be fully analysed in our next review. Understandably, the excellent fuel consumption recorded by the Isuzu FSR 800 AMT in the FOCUS Truck Test has been highlighted in recent publicity material.

Isuzu Truck SA made a significant corporate announcement during the JIMS period, and this will be fully analysed in our next review. Understandably, the excellent fuel consumption recorded by the Isuzu FSR 800 AMT in the FOCUS Truck Test has been highlighted in recent publicity material.

MAN Group

The MAN-led grouping, which also includes Volkswagen’s Constellation trucks and Volksbus models, maintained fifth position in the third quarter market rankings with an improvement of 1,2 percent in penetration. The local operation has recently announced a new management structure under executive chairman Geoff du Plessis, and has embarked on a quest to improve client support.

Recent promotional activities have emphasised the fuel economy benefits of the TGS truck series, advertised the “Trucks to Go” programme offering ready-to-use VW Constellation models at special prices, and announced the local availability of the MAN Lion’s City low-entry city bus.

Recent major orders include the 120-unit Tshwane commitment noted earlier and the sale of 80 Lion’s Explorer three-axle buses to Great North Transport in Mokopane.

Scania

Swedish manufacturer Scania improved its market share by 0,1 percentage point in the comparison between second and third quarter results, while retaining sixth position in the overall market rankings. The Scania Touring luxury coach line-up has recently been launched on to the local market.

Tata

This Indian brand held steady at seventh position overall during the third quarter, tracking the expanded market volume with a retained penetration of 5,2 percent, this being bolstered mainly by an improved MCV performance. It has been noted that Tata has been placing greater emphasis on product support in its recent promotional activities, supported by the provision of full maintenance contracts. The brand continues to place great emphasis on the value proposition offered by its products.

Iveco

Iveco’s performance improved significantly in the third quarter when compared to the immediately preceding three-month period, with an increase in sales volume of 26,2 percent, a corresponding market share boost of 0,8 percentage points and a retained eighth position in the standings.

Considerable media attention has been given to the recent appointment of the ELT dealership adjacent to the Johannesburg CBD. The latest Stralis Hi-Way flagship truck range and Daily minibus series were on view at JIMS.

Powerstar

This Chinese brand, which currently only reports sales in the EHCV segment, enjoyed a steady third quarter – tracking the growing market with a marginally increased share and retaining tenth position in the standings.

AMH/AAD

The Korean-sourced Hyundai HD Series of light trucks, reported in the National Association of Automobile Manufacturers of South Africa’s (Naamsa’s) MCV segment by this organisation, picked up 0,1 percent in the third quarter result and retained eleventh position in the market rankings. It has been reported that Hyundai’s Xcient heavy truck range, revealed at the Seoul Motor Show earlier in 2013, will be coming to South Africa.

FAW

This Chinese brand held steady during the third quarter and retained twelfth position in the pecking order. FAW has understandably given considerable publicity to recent orders received from prominent local operators, including units sold to Cargo Carriers for sugar road train operation in Swaziland, and truck mixers ordered by the Scribante construction enterprise.

FAW’s J5 8×4 truck mixer chassis has recently been added to the local product line-up.

JMC

Another Chinese manufacturer that recently joined the local reporting community, and presently appears only in the MCV segment, JMC’s third quarter volume sales were 40 percent higher than its April to June result. This resulted in a market share improvement of 0,3 percentage points and promotion to thirteenth spot in the market standings.

Babcock/DAF

The local distributors of DAF trucks returned a significantly improved performance during the third quarter, with a sales volume boost of 42,9 percent when compared to the April to June period, an increase of 0,1 percent in market share and promotion by one position to sixteenth position in the rankings. Recent publicity has centred on the sale of 15 CF85 units to NJP Transport of Bethal.

NC² – International Trucks

During September, this manufacturer recorded a zero sales return, and its quarterly result has seen demotion from thirteenth to seventeenth position in the standings. We find it quite incomprehensible that a truck brand that has been present almost continuously in the South African truck market since the early 1920s can just seemingly drift out of the market with no obvious explanation.

If the Navistar group has any intention of staying in South Africa, which has traditionally been a difficult place to re-establish a presence after an earlier withdrawal, it desperately needs to take immediate and comprehensive public relations steps to clarify its position.

VDL

Bus chassis specialist VDL recorded three unit sales during the quarter under review and retained nineteenth position in the market standings.

European van manufacturers

Of the four vehicle manufacturers continuing to compete in the MCV segment of this market only with European-sourced integral van-derived products, Peugeot, Volkswagen Commercials and Fiat improved their market shares in the third quarter when compared to their second quarter outcomes, by measures of 0,2, 0,5 and 0,2 percentage points respectively. The remaining manufacturer, Citroën, experienced a less satisfying quarter, with only seven unit sales recorded. It was demoted by two positions to finish in eighteenth position in the market rankings.

Non-reporting manufacturers

Readers should note that local sales volumes of several commercial vehicle brands, including DongFeng, Yutong, Foton and Ashok Leyland, are not yet reported to Naamsa and are, therefore, excluded from the comments and data contained in this report.

GENERAL MARKET COMMENTS

It is extremely difficult, at this stage, to gauge the ultimate effect of the strike action on the final market outcome for 2013. At the time of writing, the strikes in the component and retail motor sectors have just ended. Up to now their effects have been more evident in the export statistics for light motor vehicles than in the local market results. However, these strikes have the potential to more seriously disrupt the domestic picture in the months ahead as locally-held inventories run down and have to be replenished.

Understandably, local business confidence has been negatively impacted by the recent high incidence of industrial action. The rand has also come under increased pressure from a worsening trend in the country’s foreign trade balance, which can only deteriorate further if the vital export contribution of the motor sector continues to be disrupted.

As things stand, a final 2013 truck market of around 30 000 units still appears possible, but the outcomes of the following months will be highly influential in determining the viability of that outlook.

Published by

Focus on Transport

focusmagsa

FUSO: Driving the Future of Mobile Healthc

FUSO: Driving the Future of Mobile Healthc

New Electric Van Range Unveiled!

New Electric Van Range Unveiled!  A brand

A brand

Wondering about the maximum legal load for a

Wondering about the maximum legal load for a

The MAN hTGX powered by a hydrogen combus

The MAN hTGX powered by a hydrogen combus

Exciting News for South African Operators

Exciting News for South African Operators