Off to a good start

The first quarter of 2014 has seen strong sales of commercial vehicles, but, warns FRANK BEETON, many public holidays, and voting day, might mean it could be premature to expect the same trend in the next quarter.

The South African truck market, following on the example it had set during the 2013 calendar year when it achieved the fourth-highest annual total in its recorded history, surprised on the upside during the first quarter of 2014. When compared to its outcome during the equivalent first quarter of 2013, the market returned growth of 6,1 percent in the January to March 2014 period.

Having started the year with a muted performance, with January finishing 4,5 percent off the equivalent total for the first month of 2013, the market accelerated through February and March to the point where the consensus forecast of two to three percent growth for the 2014 calendar year started to look extremely conservative.

In retrospect, the poor January performance was the inevitable result of extremely strong sales in the latter part of 2013, including December, which caused a constrained supply situation in January that could not be completely recovered during the shortened working month.

It is now evident that the month’s result was not indicative of the demand situation, which ensured much stronger sales in February and March. However, it is possibly still too early to contemplate a substantially increased forecast for the year, with the prospect of a short month in April, a general election in May and festering industrial unrest in several sectors.

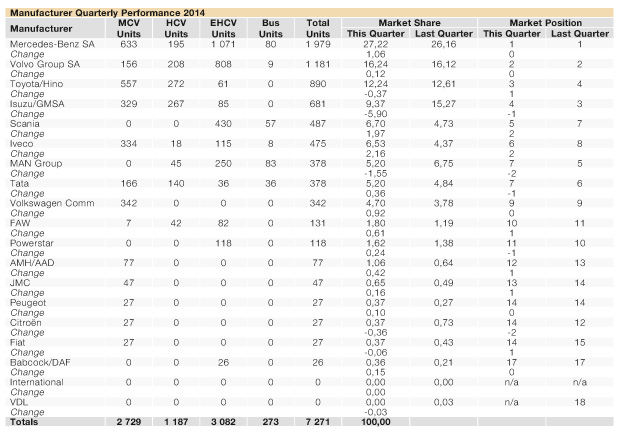

Nevertheless, the impressive first-quarter performance was broadly based, with positive year-on-year growth in all four segments. The entry-level medium commercial vehicle (MCV) category improved by 0,4 percent on its equivalent first quarter 2013 outcome, while more impressive absolute volume growth was exhibited by the cruiserweight heavy commercial vehicle (HCV) segment

Nevertheless, the impressive first-quarter performance was broadly based, with positive year-on-year growth in all four segments. The entry-level medium commercial vehicle (MCV) category improved by 0,4 percent on its equivalent first quarter 2013 outcome, while more impressive absolute volume growth was exhibited by the cruiserweight heavy commercial vehicle (HCV) segment

(3,8 percent), the premium payload extra-heavy commercial vehicle (EHCV) grouping (12,2 percent), and heavy-duty passenger buses (13,8 percent).

This indicates clearly that the EHCV segment was the main driving force behind the overall market growth, with its present strength being largely underpinned by business done by South African enterprises on the African continent outside of our national borders. This includes the export of locally manufactured goods, the reciprocal use of South African ports for the export of commodities originating from neighbouring countries, and construction contracts being executed by local companies in other parts of Africa.

On the other hand, it was pleasing to note that those market segments which mainly service local commerce, namely the MCV and HCV categories, have remained resilient, while the bus segment has benefited from the rolling out of the government’s infrastructure development initiatives.

It should be noted, however, that the total market sales volume, during the January to March 2014 quarter, was 8,1 percent smaller than the equivalent total reported in the very strong October to December period of 2013. This reduction in overall market magnitude makes the comparison of absolute sales volumes, achieved by individual participants during the two adjoining quarters, somewhat meaningless. We have, therefore, placed more emphasis on comments relating to market share movements in our review of manufacturer performance provided in this report.

As we have stated in earlier reviews, this market has owed its recent strong showing to some important trends in buyer behaviour. These include risk-averse operators shortening their fleet replacement cycles to five years or less, in order to take full advantage of deal packages that effectively underwrite the operating costs of new vehicles. These are typified by Freightliner’s recently announced five-year/800 000 km warranty (detailed below).

The growing business momentum between South Africa and its neighbours, north of our borders, has also been beneficial to both the demand for new premium long-haul vehicles, and export opportunities for quality used vehicles coming off terminated local full-maintenance leases.

We also believe that some construction companies make a practice of acquiring new vehicles in South Africa, operating them locally until all possible teething and warranty issues have been settled, and then consigning them to work on projects further north. All of these practises have the potential to add some additional momentum to the local market.

Published by

Focus on Transport

focusmagsa

!

From 1 Apri

!

From 1 Apri

Big news from FOCUS on Transport + Logist

Big news from FOCUS on Transport + Logist

FUSO: Driving the Future of Mobile Healthc

FUSO: Driving the Future of Mobile Healthc

A brand

A brand

Wondering about the maximum legal load for a

Wondering about the maximum legal load for a

The MAN hTGX powered by a hydrogen combus

The MAN hTGX powered by a hydrogen combus

Exciting News for South African Operators

Exciting News for South African Operators