The red flag rises

The Chinese commercial vehicle market is something of a mystery. We all know that, since 2009, it’s been the largest in the world. But who are the major players? What products are they developing? And should other manufacturers around the world be a tiny bit afraid? CHARLEEN CLARKE travelled to China in order to produce this special report …

Fear. You can practically smell it when you mention the word “China” in international trucking circles. It’s a fear of the unknown, and a worry at the relatively short period of time that has seen China catapult to the world’s number one truck market.

It all started in 1953, when Mao Tse Tung set about creating an automotive empire. At the time, the country had emerged from eight years of war against Japan and three years of civil war between the Communists and the Guomindang. The automotive industry didn’t exist.

Chairman Mao was determined to change this and, with the assistance of its main ally, the Soviet Union, he established First Automobile Works (now commonly known as FAW) in 1953. Chairman Mao was exceptionally proud of his new company and its first medium-duty truck; the model CA10, which immediately became a daily sight to people throughout China and a symbol of industrial pride to the country. China had entered the trucking industry with a vengeance!

Chairman Mao was determined to change this and, with the assistance of its main ally, the Soviet Union, he established First Automobile Works (now commonly known as FAW) in 1953. Chairman Mao was exceptionally proud of his new company and its first medium-duty truck; the model CA10, which immediately became a daily sight to people throughout China and a symbol of industrial pride to the country. China had entered the trucking industry with a vengeance!

Mao Tse Tung adopted a different strategy when he launched his second automotive company, rather unimaginatively called Second Automotive Works (SAW). In 1969, when launching the company, he decided to hide it in the Hubei Province, a remote, mountainous region of China – ostensibly to protect the factory from any danger.

When he encountered the company’s products for the first time, he experienced even more pride, saying that they were akin to “the wind that blows from the east” – or Dongfeng, the company’s name today. This name is particularly significant; the Chinese believe that the east wind will blow all over the world …

CHINA TODAY

Fast forward 45 years and both FAW and Dongfeng are still going strong. In fact, the former now employs 120 000 people around the world and sells products in over 70 countries. The Dongfeng Motor Group, on the other hand, employs 160 000 and it has lofty international aspirations.

“We want to develop a global and well-recognised brand. We don’t only want to be a Chinese brand. We want to increase our overseas sales to 20 percent of our business within ten years. It’s not just about selling overseas, however, it’s also about earning trust. The trust is more important than the volume,” reveals Huang (Gary) Gang, president of Dongfeng.

“We want to develop a global and well-recognised brand. We don’t only want to be a Chinese brand. We want to increase our overseas sales to 20 percent of our business within ten years. It’s not just about selling overseas, however, it’s also about earning trust. The trust is more important than the volume,” reveals Huang (Gary) Gang, president of Dongfeng.

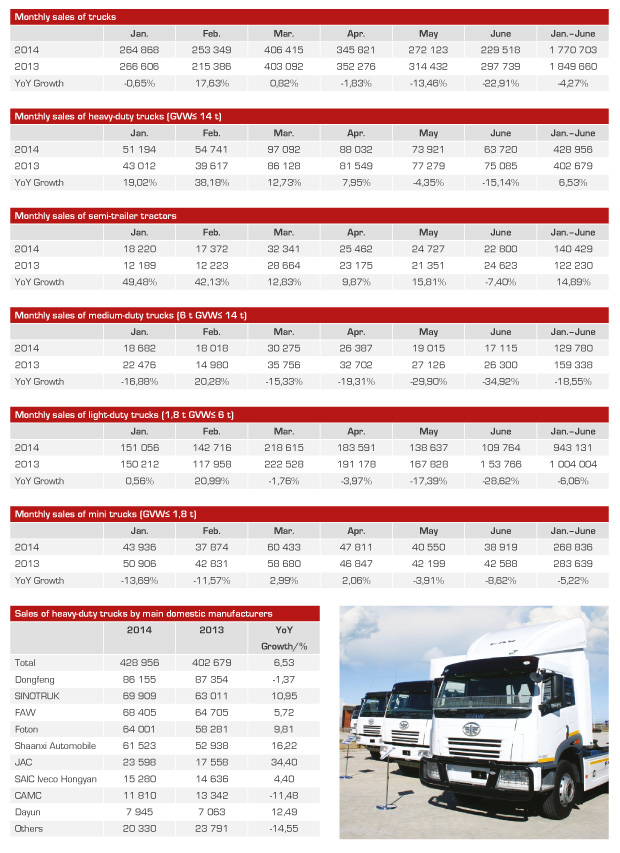

The reality is that companies such as these two state-owned enterprises (SOEs) do have a captive market on their doorstep. Chinese customers purchase over four million trucks a year (in 2010 commercial vehicles sales passed the one million mark for the first time, thanks not least to the booming Chinese construction sector).

Most of those trucks are purchased by SOEs. In fact, from January to May this year, China’s top ten heavy truck companies (all SOEs) achieved a 96,89 percent share of the market. That’s because this is an exceptionally price-sensitive market, and Chinese trucks cost one third of their premium (European) counterparts. Not surprisingly, premium trucks account for a mere one percent of this market …

These SOEs also have a rather well-heeled backer. “We are 100 percent owned by the central Chinese government, as is Dongfeng,” confirms Robert Doub, who is in charge of after-sales marketing and after-sales support development at FAW. “Some other truck and car makers are owned by provincial and local government.”

Does this mean that these businesses can rest on their laurels? “No,” says Doub. “We need to make a profit, but the government has a responsibility to serve the people and so, within an SOE, we work very hard to create jobs. We strive harder to create employment, and probably employ more people, than a typical private-sector company.”

Does this mean that these businesses can rest on their laurels? “No,” says Doub. “We need to make a profit, but the government has a responsibility to serve the people and so, within an SOE, we work very hard to create jobs. We strive harder to create employment, and probably employ more people, than a typical private-sector company.”

Still, this doesn’t mean that companies such as FAW and Dongfeng have it easy. “We have way too many commercial-vehicle producers in China,” explains Doub. Some truck makers – Chang’an Automobile Group, Brilliance China Automotive, Anhui Jianghuai and Jiangling, for instance – only produce light commercial vehicles.

Other major players include Shanghai Automotive Industry Corporation (SAIC), Beijing Automotive Industry Corporation (BAIC), JAC, Sinotruk, the China National Heavy Duty Truck Company (CNHTC), China CAMC Engineering Co (CAMC), Dayan and the Torch Automotive Group, whose heavy trucks are distributed under the name Shaanxi.

Doub insists that this proliferation of manufacturers is unsustainable. “The market needs consolidation, and the Chinese government is certainly in favour of this,” he tells FOCUS.

Foreign companies, on the other hand, are certainly not big fans of consolidation and they are clamouring for a share of this lucrative market. Western European truck makers that are competing in China include Volvo, Scania, Iveco, Renault, DAF, MAN and Mercedes-Benz.

Collectively, they have invested billions of euros in the world’s biggest commercial vehicle market. Only three – Mercedes-Benz, Volvo and Scania – have achieved a modicum of success. The rest are waiting with bated breath, hoping that Chinese customers will appreciate the benefits afforded by premium trucks – one day.

Collectively, they have invested billions of euros in the world’s biggest commercial vehicle market. Only three – Mercedes-Benz, Volvo and Scania – have achieved a modicum of success. The rest are waiting with bated breath, hoping that Chinese customers will appreciate the benefits afforded by premium trucks – one day.

Many of these companies have realised that a joint venture (JV) is a logical way to go. This has been borne out by Daimler, which joined forces with Foton in 2011. Stefan Albrecht, executive vice president of Beijing Foton Daimler Automotive (BFDA), says that the JV has proved to be exceptionally successful. “Our plants have an annual capacity of 160 000 units, which can be extended to 200 000, and we now have 450 dealers and more than 2 000 service outlets in China,” he tells FOCUS.

BFDA will expand its production footprint in China shortly, with the opening of a heavy-duty engine plant. It will produce Mercedes-Benz OM457 engines, which will be installed into the JV’s Auman-branded trucks.

LEGAL REQUIREMENTS

Exactly what sort of trucks are these companies selling, and what do Chinese customers want? Let’s kick off with a discussion surrounding the legal requirements in China. According to Yu Jing, editor-in-chief of China’s Commercial Vehicle magazine, the maximum trailer length is 13 m, and the total length of a tractor with a trailer is 16,5 m.

Van-type body trailers, which are used on high-grade highways, have been limited to a maximum length of 14,6 m since January 1, 2008. Articulated vehicles with a van-type body trailer are subject to a maximum length of

Van-type body trailers, which are used on high-grade highways, have been limited to a maximum length of 14,6 m since January 1, 2008. Articulated vehicles with a van-type body trailer are subject to a maximum length of

18,1 m. The maximum width is 2,55 m while the maximum height is four metres. The maximum payload is 22,5 t.

In the past, 6×2 truck tractors were the most popular models, but, thanks to changing weight restrictions, 6x4s have become more popular.

Irrespective of which configuration Chinese buyers opt for, they most certainly want something that is cheap. Sophisticated technology is not valued. Neither are safety and quality. This means that it’s almost impossible for Western brands to compete – they are relegated to specialised areas (hazardous goods and cement trucks, for instance). Japanese and Korean brands, which are sandwiched in between the Chinese and Western European brands from a pricing perspective, fare a tiny bit better.

Like so many operators elsewhere, Chinese operators also want to maximise payloads – and overloading has been a massive challenge in the country. “In the old days, in north east China (where I am from), the underpowered trucks all stayed in the right-hand lane and the road literally sank from the weight of the trucks,” reveals Doub.

Think that’s extreme? In November last year a Chinese truck driver was fined 2,7 million Yuan – the equivalent of 100 years’ average income for city dwellers – and jailed for three years after his overloaded vehicle caused a bridge to collapse. Zhang Wenjun’s sand-laden lorry weighed 160 t when he tried to cross a concrete bridge, in Huairou on the outskirts of Beijing, and the structure gave way.

Think that’s extreme? In November last year a Chinese truck driver was fined 2,7 million Yuan – the equivalent of 100 years’ average income for city dwellers – and jailed for three years after his overloaded vehicle caused a bridge to collapse. Zhang Wenjun’s sand-laden lorry weighed 160 t when he tried to cross a concrete bridge, in Huairou on the outskirts of Beijing, and the structure gave way.

Thankfully, incidents like these are not quite as common as they used to be. “This situation is changing. The government has built more weighbridges and they’re manned all the time. It has realised that a modern road system is integral to the economic growth of the country,” Doub says.

Captains of the Chinese industry say that there are other positive factors emerging. “Customers are starting to realise that they shouldn’t only focus on the initial investment. More and more smaller companies and owner drivers are investing in premium technology,” Kamlarp Sirikittiwatn, vice president vehicle sales and marketing (China sales) at Volvo, tells FOCUS. He reveals that Volvo opened a representative office in China in 1992, although the company has been selling its vehicles in the country since 1934.

Dongfeng’s Gang agrees. “Chinese customers are certainly becoming more aware of the total cost of ownership. One of the reasons is the advent of online shopping in this country. Deliveries have to be fast, so uptime is essential,” he points out.

Sirikittiwatn says that the growing sophistication of the market has resulted from considerable education on the part of companies such as Volvo. “We are educating the customers, explaining to them that we don’t only provide a truck – we provide complete support and profitability over the lifecycle of the vehicle.”

Sirikittiwatn says that the growing sophistication of the market has resulted from considerable education on the part of companies such as Volvo. “We are educating the customers, explaining to them that we don’t only provide a truck – we provide complete support and profitability over the lifecycle of the vehicle.”

But FAW’s Doub doesn’t believe that the market is becoming more sophisticated. “I don’t see how the European trucks will ever be able to break into the mainstream business in China – because Chinese customers don’t want them. They want a cheap truck. I’m not saying we’re building inferior trucks. The truck we’re building today is light years from the truck we built ten years ago. Our level of performance, durability and reliability has risen dramatically. Is the level of refinement the same as a European truck? No, it’s not. If FAW wanted to build a truck equal to a Benz or MAN, we could do it tomorrow, but the Chinese market doesn’t want it,” he contends.

Gang has a different opinion. “We have 44 years of experience in the truck business and we are very focused on this segment. Over these 44 years, we have developed strong engineering capability and the ability to develop the right product for the right segment. We have a very strong distribution network and we understand the customers’ requirements – but we need to learn more,” he tells FOCUS.

Part of that learning process will come courtesy of Volvo, which acquired 45 percent of Dongfeng Commercial Vehicles last year. “We are strong here (in China) and Volvo is a global giant. Both are big groups. We have strong synergy and through the cooperation with Volvo we can strengthen our competitiveness. This can support our goal of entering the global market,” says Gang.

Part of that learning process will come courtesy of Volvo, which acquired 45 percent of Dongfeng Commercial Vehicles last year. “We are strong here (in China) and Volvo is a global giant. Both are big groups. We have strong synergy and through the cooperation with Volvo we can strengthen our competitiveness. This can support our goal of entering the global market,” says Gang.

FUTURE PROSPECTS

Looking to the future, there can be little doubt that many Chinese companies will continue to work with manufacturers from other parts of the world. Will this benefit the Chinese companies? Almost certainly – although not nearly as much as in the past; Chinese companies possess huge technological know-how (Dongfeng, for instance, is quite happily building engines, axles and various other components; Doub says FAW’s new 13-litre engine is simply sensational).

Will this benefit the companies from abroad? Not as much; trucks that emerge from JVs almost never bear the foreign company’s name (à la BFDA’s Auman). This – and the nation’s propensity to buy cheap local trucks – means that it’s hard (if not impossible) for foreign companies to establish brand equity.

Meanwhile, Chinese companies will work at upping their quality game. BFDA’s Albrecht says one cannot compare the quality of Chinese and Western European trucks – at present. “But Chinese original equipment manufacturers (OEMs) will improve  their quality. They have a clear target; they want to export everywhere, including to Europe. This means improving quality. When will this happen? That’s a very tricky question,” he ponders.

their quality. They have a clear target; they want to export everywhere, including to Europe. This means improving quality. When will this happen? That’s a very tricky question,” he ponders.

Of course, Chinese companies could settle for supplying the local market, which will almost certainly keep them churning out trucks well into the future. Road will remain the mode of choice within China well into the future, it seems. According to KPMG, in terms of traffic in tonnes per kilometre, road freight transport has seen enormous growth over the last ten years, mostly because the Chinese government has been strongly committed to road construction.

Between 2000 and 2010 alone, the length of national highways grew by an impressive 2,5 million kilometres. The current four million kilometres is therefore certain to expand further. By 2020, the expressways – primarily for inner- and inter-city traffic – will also grow from 55 000 km to 85 000 km. In addition, the Chinese government recently eliminated tolls for secondary highways. These and similar developments will help to achieve continuously strong growth in the road transport of goods.

Chinese companies could also opt to maintain the status quo when it comes to quality and export to the less discerning  markets – South Africa, Brazil, India, Mexico and Russia, as well as Southeast Asia.

markets – South Africa, Brazil, India, Mexico and Russia, as well as Southeast Asia.

However, chatting to Dongfeng’s Gang, I believe that the industry would love to see China’s red flag rising all over the world. Not right now, but in time. “Our home market is easy for us. We understand our customers’ requirements. We respond quickly when it comes to bringing new technology. Going abroad is different. We need time to prepare our capabilities and technology. We need to focus on emissions; we are on China 4, Europe is on Euro 6. That’s a big gap. Right now, we need to learn and the European market is not our focus,” he reveals.

That’s the situation right now. But one thing is obvious: the wind that blows from the east will almost certainly blow to all corners of our globe sometime soon …

Published by

Focus on Transport

focusmagsa