Extra-special extra-heavies

GAVIN MYERS walks through the sands of time and peers into the future of extra-heavy vehicles and long-distance transport with experts VIC OLIVER and FRANK BEETON.

The more things change, the more they stay the same – so the saying goes. But does this hold true for extra-heavy commercial vehicles (EHCV) and the transporters who operate them? What better way to find out than to discuss the issue with two of the country’s long-standing trucking experts, FOCUS columnists Vic Oliver of Vic Oliver and Associates, and Frank Beeton, industry analyst at Econometrix. Between them, these two stalwarts of South Africa’s commercial vehicle industry have over 80 years’ experience.

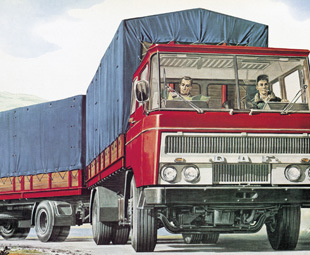

“When I started selling extra-heavy commercial vehicles 50 years ago, the price of an International 6×4 truck-tractor was approximately R8 500,” says Oliver. “The vehicle was equipped with a 220 hp (164 kW) engine – which was considered to be a powerful diesel engine – and not fitted with any fancy gadgets. Modern truck tractors have vastly improved over the years, but have also become expensive.”

Not without reason though. Modern EHCVs are worlds apart from their forbearers. High-powered electronically-controlled engines; automated mechanical transmissions (AMT); disc brakes (now even electronically controlled) and driver aids such as cruise control, active braking, traction control and trailer stabilisation stability systems are just some of the technological improvements. As we know all too well, these vehicles are being forced to become “greener” too – cutting exhaust emissions and fuel consumption in line with stringent international legislation.

In fact, when comparing exhaust gas emissions from Euro-2 engines (which the current level of vehicles sold in South Africa have to comply with) and modern Euro-6 engines (soon mandatory in Europe), the stark contrast in numbers clearly illustrates how much cleaner modern, advanced engines are. Introduced in 1996, the Euro-2 emission standard allowed for a maximum of 7 g/kWh of harmful nitrogen oxide gas (NOx) and 0,15 g/kWh of particulate matter (PM) emissions, while forthcoming Euro-6 legislation prohibits anything above 0,5 g/kWh and about 0,01 g/kWh respectively.

In fact, when comparing exhaust gas emissions from Euro-2 engines (which the current level of vehicles sold in South Africa have to comply with) and modern Euro-6 engines (soon mandatory in Europe), the stark contrast in numbers clearly illustrates how much cleaner modern, advanced engines are. Introduced in 1996, the Euro-2 emission standard allowed for a maximum of 7 g/kWh of harmful nitrogen oxide gas (NOx) and 0,15 g/kWh of particulate matter (PM) emissions, while forthcoming Euro-6 legislation prohibits anything above 0,5 g/kWh and about 0,01 g/kWh respectively.

“New vehicle buyers have no choice, and are compelled to buy their new vehicles with all the high-tech equipment,” says Oliver. This is something of a double-edged sword for drivers and operators, as the vehicles require specialised maintenance tools and skilled drivers. But Beeton sees this as a positive that should raise the standard of driving and operating.

However, Oliver cautions that expensive diagnostic equipment is needed to service vehicles, and good technicians have to be found and retained. “Finding skilled technicians is a difficult task and extra-heavy vehicle operators would be well advised to carefully consider buying their new vehicles with service or full maintenance contracts,” he says.

Oliver, whose core business is now training, says many of the newer generation of drivers present similar challenges for operators in that they aren’t all capable of operating the multi-speed gearboxes fitted to many of the trucks sold today. This inevitably results in damaged gearboxes that are extremely expensive to repair. “Sadly many of the older, experienced drivers have died, especially from Aids,” he says. “These older drivers had the skill and experience to properly operate multi-speed manual transmissions without breaking the gearbox.” The arrival of AMTs has helped to reduce this problem, with more and more operators buying trucks fitted with these. Encouragingly, as Oliver is quick to point out, many long-distance truck drivers are still highly professional, and are to be respected for their skills and courtesy to other road users.

Beeton adds that the increase in less experienced drivers handling the largest of rigs makes accidents and road safety a serious concern. This, combined with the lack of legislated maximum driving hours and operators who force their drivers to drive excessive hours, remains one of the biggest problems – and one that causes many long distance drivers to have accidents, adds Oliver.

Beeton adds that the increase in less experienced drivers handling the largest of rigs makes accidents and road safety a serious concern. This, combined with the lack of legislated maximum driving hours and operators who force their drivers to drive excessive hours, remains one of the biggest problems – and one that causes many long distance drivers to have accidents, adds Oliver.

So too does overloading on routes not controlled by tolls. Overloading has been prevalent for years, and this practice has knock-on effects. Roads are designed to withstand a certain number of standard axle-load repetitions that will result in a certain rate of deterioration. The performance of a road is mostly influenced by the loading magnitude, configuration and number of load repetitions by heavy vehicles. Overstressing of the subgrade (the bottom-most and strongest layer in the construction of a road) by axle loads causes it to deform, making it unable to support these axle loads.

Some roads, especially older back roads, are simply not intended to deal with EHCVs – and with more and more unscrupulous operators making drivers take these routes in the push for profits, major infrastructure damage occurs. This again comes back to road safety. Says Beeton: “The increase in long-distance road haulage has put severe pressure on the country’s road infrastructure, which – with the exception of the toll roads – has deteriorated badly.” He adds that this is because an ever-increasing proportion of line-haul freight and commodities, such as coal, is being transported by road because of the inability of the local rail infrastructure to provide the required level of service to industry and business.”

But Beeton notes that determined efforts by Government and Transnet could swing freight transport back to rail in the next few years. This will be a delicate balancing act, as any shift back to rail will harm the economy if not justified in terms of efficiency and cost.

But Beeton notes that determined efforts by Government and Transnet could swing freight transport back to rail in the next few years. This will be a delicate balancing act, as any shift back to rail will harm the economy if not justified in terms of efficiency and cost.

Nevertheless, the EHCV sector – especially in terms of long-distance haulage – remains highly competitive both in terms of the operators vying for business and the trucks available to them. Within the last decade or so, South Africa has experienced an influx of new manufacturers from the East due to strengthening trade relations and easing of import restrictions. Many have found or are finding a successful niche in the construction sector with tippers and mixers, and are starting to expand into the long-haul market as well. Powerstar showed its V3 truck-tractor at last year’s Johannesburg International Motor Show, Tata will soon be launching its Prima “world truck” and FAW recently launched its

J6 6×4 truck-tractor (see page 24).

Beeton expects these new players to find it more difficult in the long-distance arena. “These operators are more concerned with reliability, operating costs and product support than up-front purchase price,” he says. “The Asian manufacturers need to build credibility in that area, which could take five to 10 years.”

This is because competitiveness in long-distance road freight requires great professionalism and efficiency – something our larger operators are oft praised for. “Operating costs are extremely high and profit margins are tight,” says Oliver. As ever, operators cannot do much to control fixed operating costs, but variable operating costs can be controlled and minimised.

Fuel is the biggest cost factor and is unpredictable as oil prices and taxes change regularly. “This is where big savings can be made, provided that the driver is professional, doesn’t drive the vehicle harshly or abuse it, and works together with the operator to save fuel,” says Oliver. “If optimum fuel consumption is obtained, the other variable costs – such as maintenance, repairs and tyre replacement costs – will automatically be minimised.”

It’s still all about man and machine (make that humankind and machine), but clearly things have changed. This is a brave, new sophisticated and thankfully increasingly environmentally-friendly world.

Published by

Focus on Transport

focusmagsa