How the tough survive

This month we look into the slightly bizarre race between General Motors and Ford to develop the “most powerful heavy-duty diesel pickup”. On the market front FRANK BEETON reports on the growing trend toward joint ventures that take advantage of rapidly expanding developing country markets by reporting on Iveco’s moves into China.

Iveco Looks Increasingly East

Iveco SpA of Turin, the commercial vehicle division of Fiat SpA, is looking increasingly to its Chinese joint ventures as a source of profitability and products for world markets. During 2009, the company built and sold more trucks in China than in the rest of the world, with the volume expected to increase by a further 50% in 2010, and then double over the next five years. At that point, Chinese production is expected to make up around two-thirds of Iveco’s global volumes. Iveco’s single-partner joint ventures comprise firstly, Naveco Nanjing, which produces Dailys and the Yuejin range of cab-over-engine models covering the 3.5 to 10 ton Gross Vehicle Mass spectrum. The second is SAIC-Iveco Hongyan producing Genlyon, Tampa and Hongyan heavy trucks. Finally, SAIC-Iveco FPT Hongyan produces engines and is linked to Fiat’s Powertrain division.

The Chinese operations serve a domestic commercial vehicle market of more than 2.5 million units, and draw from a 900-strong local supplier base, which is to be increasingly utilized by Iveco’s manufacturing operations globally. Iveco’s stated philosophy is to increasingly engage with China as a global source, and to provide continuously updated technology, in order to take full advantage of the region’s optimal production costs. Export volumes from the Chinese JV’s stood at a modest 1 000 units in 2009, but are planned to reach a level of 31 000 units by 2014, with target markets identified in South America, Eastern Europe, the Middle East and Africa.

The Yuejin light/medium truck production totalled 80 000 units in 2009, while Hongyan-sourced heavy truck volumes reached 30 000 units. Future product plans for the Chinese operations include an updated Daily van range in mid-2011, a completely new Euro 6-compliant replacement in late 2013, an updated EuroCargo cruiserweight in mid-2012, a completely new Leoncino cab-over design to cover the GVM range from 3.5 to 12 tons from 2013, an upgraded Stralis in mid-2012, and a completely new heavy duty design in 2013/14. The Leoncino range is being specifically planned for export sales, and is expected to be made available in certain Eastern European, Middle Eastern and African markets.

The Yuejin light/medium truck production totalled 80 000 units in 2009, while Hongyan-sourced heavy truck volumes reached 30 000 units. Future product plans for the Chinese operations include an updated Daily van range in mid-2011, a completely new Euro 6-compliant replacement in late 2013, an updated EuroCargo cruiserweight in mid-2012, a completely new Leoncino cab-over design to cover the GVM range from 3.5 to 12 tons from 2013, an upgraded Stralis in mid-2012, and a completely new heavy duty design in 2013/14. The Leoncino range is being specifically planned for export sales, and is expected to be made available in certain Eastern European, Middle Eastern and African markets.

Iveco’s European plants reportedly achieved only 35% utilization in 2009, when the market for vehicles over 3.5 tons GVM on the Continent dropped to some 500 000 units, having been at 780 000 units in 2008. Utilization levels are planned at around 50% in 2010, as the market begins its recovery, and total European sales volumes are expected to return to levels above 700 000 units in 2014.

Fiat Splits its Businesses

Fiat SpA has announced that, from 1 January 2011, it will spin off the activities of its truck division Iveco and tractor manufacturer Case New Holland, together with the industrial and marine business of Fiat Power Train Technologies to form a new entity to be named Fiat Industrial SpA. The company sees this as a logical development from its historic view that everything powered by an engine, including railway equipment, aircraft, automobiles, trucks, tractors and construction equipment could be comfortably housed within one “Fiat” conglomerate. It will now face the reality that the economic cycles, profit margins and capital requirements of the truck-related businesses are quite different from their lighter counterparts.

Remaining behind within the downsized Fiat SpA will be Fiat Group Automobiles, Ferrari, Maserati, Magnetti Marelli, Teksid, Comau and the light vehicle portion of FPT Power Train Technologies. Both parent companies are to be listed separately on the Milan stock exchange, and will be free to explore their own potential alliances. However, continuing intercompany co-operation is expected in the areas of Fiat’s World Class Manufacturing programme, diesel technology development, research and development, and common suppliers.

In the ongoing aftermath of 2007’s DaimlerChrysler breakup, Fiat Group companies are now exploring opportunities to distribute more of their products through the Chrysler LLC outlets they now control in North America. First priority will go to replacing the Mercedes-Benz Sprinter van range, of which supplies to Chrysler Ram dealers are to be terminated over the following year. Its logical replacement could be either Fiat’s Ducato, or Iveco’s Daily, and both are under consideration. The possibility of stretching the range upwards to include cruiserweight EuroCargo models is also reported to be under study, but further vertical extension to include Iveco’s cab-over heavy duty models with in-house drivelines is unlikely, given the US market’s well-known appetite for traditional “conventional” cab layouts and familiar engine/transmission choices.

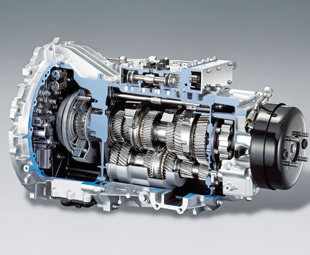

Alternative Transmissions 1 – The Dual Clutch Gearbox

The global motor industry has moved way beyond the traditional choice between “manual” and “automatic” (i.e. torque converter/epicyclic) gearboxes. Advancing technology has enabled “automated” transmissions to rival the most skilled drivers of conventional manual mechanical gearboxes in terms of performance and economy. In essence, a computerised electronic control module makes the choices of when, and how many gears, to shift. It also ensures that all the parameters, including engine and road speed, are appropriately managed.

However, even the best automated mechanical transmissions (AMT’s) still have to go through the normal release accelerator/declutch/shift/re-engage clutch sequence, with its accompanying distinct “steps” and drive interruptions, so there was still room for a better solution. Back in the 1980’s, Porsche developed a dual-clutch gearbox for its racing cars, in which the odd and even gear sets are each coupled to their own clutch, both of which transmit rotational forces to a common output shaft. By engaging and disengaging the clutches sequentially, with a small timing overlap, almost seamless gearchanges from odd to even numbered gears are possible. Changes can be called up automatically by an ECM, or driver inputs can be used.

However, even the best automated mechanical transmissions (AMT’s) still have to go through the normal release accelerator/declutch/shift/re-engage clutch sequence, with its accompanying distinct “steps” and drive interruptions, so there was still room for a better solution. Back in the 1980’s, Porsche developed a dual-clutch gearbox for its racing cars, in which the odd and even gear sets are each coupled to their own clutch, both of which transmit rotational forces to a common output shaft. By engaging and disengaging the clutches sequentially, with a small timing overlap, almost seamless gearchanges from odd to even numbered gears are possible. Changes can be called up automatically by an ECM, or driver inputs can be used.

Till recently, most DCT applications have been found on high performance cars. A recent announcement from Mitsubishi Fuso Truck and Bus Corporation has moved the technology squarely into the commercial arena. Daimler Trucks-controlled MFTBC calls its six-speed unit the M038S6 “Duonic” dual-clutch transmission, and special features include a park facility, non-wearing wet clutches, and a low-speed creep/hill-hold function. The transmission can be operated in both manual and fully-automatic modes. This unit will be paired with a new 4P10 three-litre diesel engine in upcoming two-pedal light truck applications, and the manufacturer is claiming an 8-10% fuel consumption reduction when compared to equivalent current products.

Alternative Transmissions 2 – Full Automatic with Torque Convertor Lock-up

Notwithstanding the advanced development state of automated mechanical transmissions, including the aforementioned dual clutch units, there are still some applications where operators prefer the more traditional type of “full automatic” with torque converter. Typical are high-frequency stop-start operations, like kerbside refuse collection, where the vehicle operates for extended periods at very low speeds, and does not get a chance to “stretch out” through the upper gears. Even though full autos may still carry an overall fuel consumption penalty, operators accept this in the interests of the reduced drive-train component wear that comes with the smooth acceleration provided by a torque converter.

In the past, efforts have been made to improve the fuel consumption performance of full autos. Most significant was the introduction of the “lock up” clutch in the 1980’s, which by-passed the torque converter, and cancelled out any disparity between engine and transmission input rotational speeds when the gearbox was operating in its overdrive top gear ratio. This innovation resulted in improved fuel economy at higher speeds, but had no influence on the slippage characteristic of the torque convertor when it came into operation at lower road speeds. However, technology advances continuously, and a further design enhancement has now addressed this problem, with surprisingly effective results.

Hino Australia recently launched the 614 Auto Dump lightweight tipper into its domestic market. This five-and-a-half ton GVM model combines a Hino 4.0-litre common-rail direct injection diesel, producing 100 kW (134 hp) with Aisin’s A860E six-speed close-ratio double-overdrive transmission. With a gear ratio spread from 3.74 to 0.63:1, this gearbox differs from “conventional” automatics in having a torque converter lockup facility which operates on all five of its higher ratios. This provides a direct mechanical connection between engine and transmission between each gear change. It substantially reduces slippage in all operating scenarios other than the very initial stages of take-off from rest, and enhances the engine over-run braking effect. The latter characteristic, together with an automatic downshift function, enables full use of the exhaust brake to control hill descents. The transmission also selects neutral automatically when the vehicle is at rest with the brakes applied.

In a recent road test in metropolitan Sydney, one of these units was reported to combine a gradeabilty of 53.2% at full GVM with 100 km/h cruising speed, and returned fuel consumption results that almost equalled a similar sized, but considerably more expensive hybrid driveline vehicle! Should this technology prove capable of similar results under a variety of operational conditions, there could be a broader range of marketing opportunities for full auto transmissions. The same principles should apply in larger units, and while it is unlikely that full autos will replace AMT’s, or even manual transmissions, in line-haul rigs, the operational spectrum that lies between the extremes of refuse collection and long distance haulage is full of applications where they could come into consideration.

Cummins Developments

US diesel engine manufacturing icon Cummins Inc has announced an investment of approximately $US 100 million in the expansion of the high-horsepower technical centre and product line at its facility located in Seymour, Indiana. This facility currently manufactures a range of “high-horsepower” diesel and natural gas engines, designated V903, K19, QSK19 and QST30 that are larger than the up-to-15 litre Cummins units normally found in on-highway truck applications. They are more commonly used in mining, power generation, marine, oil and gas and railway applications, although some are to be found powering the more extreme road train combinations operating in the Australian “outback”. This new investment is intended to expand capacity for the future development and manufacture of clean-diesel and natural gas fuelled engines. There are also plans to add a new larger-displacement power unit to the product line-up.

Cummins has also announced that it has received US Environmental Protection Agency certification for its new ISX11.9 automotive diesel, confirming that this engine complies with the latest EPA2010 emission requirements. This power unit is currently entering production at Cummins’ Jamestown Engine Plant, which has been subject to a recent investment of more than $US 63 million in preparation for this new product line. Cummins is aiming the ISX11.9 specifically at on-highway vocational and specialty vehicles, working in dump, mixer, refuse, tanker, fire and emergency, recreational and passenger-carrying applications. Its well-established ISX 15-litre power units will continue to cater for line-haul operations. Common componentry used by both displacement applications include an enhanced cooled Exhaust Gas Recirculation system, a single Holset “moving sidewall” variable-geometry turbocharger, and the Cummins/Scania co-developed XPI high-pressure common-rail fuel injection system. This engine uses Selective Catalytic Reduction exhaust aftertreatment to help achieve the EPA2010 emission requirements.

The spectrum of outputs covered by the ISX11.9 family ranges from 231 to 336 kW (310 to 450 hp) and 1 150 to 1 650 lb-ft (1 559 to 2 237 Nm). “Dressing” options include single- and dual-cylinder air compressors, and front or rear mounted power take-offs. Testing of the new power unit is claimed to have covered 1.44 million miles and nearly 19 000 hours of operation, using 20 unique vehicle installations.

When news of the upcoming launch of the new ISX11.9 engine first broke in the US early last year, it raised a few eyebrows in the trucking community. It was seen as a “medium-bore” replacement for the 10.8-litre ISM model, which, in turn, had grown out of the 1970’s-vintage 10-litre Cummins unit. Observers have suggested that this 11.9-litre engine is a derivative of the 13-litre unit, with a power range from 300 to 405 kW (400 to 545 hp) that was developed in China following the establishment of a joint venture, in that country, between Cummins and Dongfeng in 2005. There was some surprise that the US version was not pegged at 13 litres displacement, to compete more directly with similar sized in-house engines offered by Detroit Diesel, Volvo, Navistar (MAN) and Paccar (DAF).

Pick-Up Torque Race

Global Focus has reported regularly on manufacturers’ claims to build “the world’s most powerful truck”. We have expressed our reservations regarding the real-world value of such claims, but this will certainly not halt the inevitable progression of this contest, such is the perceived status that it enjoys in the minds of corporate management and their advertising agencies.

Judging by a recent report that we read on a US industry website, there is similar hotly-contested competition in the North American market for the title of “most powerful heavy-duty diesel pickup”. Inevitably, the main combatants are those age-old rivals General Motors and Ford. During August, Ford fired the latest salvo in its efforts to gain supremacy in this contest. Having recently introduced its own 6.7-litre Power Stroke diesel to replace an engine previously sourced from Navistar International for its Super Duty range, Ford saw fit to boost the torque output by 88 Nm, to give it an edge over GM’s 6.6 litre Duramax V-8. The relevant torque ratings now stand at 1 085 Nm (Ford) and 1 037 Nm (GM).

It just so happens that GM was launching its latest GMC and Chevrolet pickups as this announcement was made. It seems Ford had timed its move to perfection, stealing much of its rival’s thunder! Incidentally, the torque upgrade was made possible by a software change that did not require any expensive re-engineering of the power unit. Additional testing and validation had been carried out during the past few months when the lower torque version was installed in production units. The new control module reprogramming is available as a free retrofit to all 2011 Super Duty owners who previously took delivery of vehicles with the lower torque rating.

For the record, the third contestant in this “race” is Chrysler, whose Dodge Ram pickup is powered by a 6.7-litre Cummins diesel that “only” puts out 881 Nm of torque, which, anywhere else on the planet, would be sufficient for an eight ton truck! Advertising copywriters claim that the benefits of the extra torque in pickups include improved fuel consumption, more use of higher gears, and improved performance, when performing duties such as towing horse trailers and ocean-going boats, or plowing through swamps.

GLOBAL SNIPPETS

IAA this month

The IAA Hannover truck show will run from 23 to 30 September this year. With 1 619 exhibitors, it is the biggest of its type in Europe by far, with 190 000 m2 for indoor and 30 000 m2 for outdoor exhibits. A total of 730 of the exhibitors are German firms. Amongst the 889 foreign exhibitors, Turkey leads with 107, reflecting the strength of its growing automotive industry. The 200 or so van, truck, trailer, bodybuilder and bus stands take up nearly 60% of the exhibition space.

FOCUS will be at the IAA, of course… read all about it in our November issue.

First electric van from Mercedes

Mercedes-Benz says it believes its Vito E-Cell is the first ex-factory battery-electric van. The new van has a 130 km range and is “ideally suited for inner-city operations” and in environmentally sensitive areas. Neither payload weight nor cubic capacity is cut by the emission-free driveline and batteries and the vehicle is virtually silent to run. The firm says it is building a 100-strong batch and plans to make 2 000 more from 2011.

DAF goes for EEV

DAF now offers an Enhanced Environmentally-friendly Vehicle (EEV) version of its 6.7 litre Paccar GR-engine in certain overseas markets. This move makes the firm the first truck maker with a full, EEV ultra-low emission engine range. EEV emit at least 33% less particulates than Euro 5 levels. DAF says that some of its smaller engines can hit EEV emission levels without the need for particulate filters. This saves about 30 kg a truck and frees space on the chassis that may be used for accessories or extra fuel capacity.

Iveco launches 7 t Daily and EcoDaily

Iveco has extended its UK range of Daily and EcoDaily vans and light trucks with a series of new 7 t van, chassis cab and crew cab models. These offer a 7 t body and payload allowance, 470 kg more than 6.5 t models. Iveco says this is more than many medium range trucks and “testament to the Daily’s truck-derived heritage”. The chassis is 2 174 m wide, making the range ideal for urban work where Iveco says it offers a “viable alternative” to fleets running 7.5 tonners, particularly those delivering dense goods such as newspapers, stationery and drinks.

Things on the up in Germany

For the German commercial vehicle industry the signs of recovery are “clearly visible”. This year commercial vehicle registrations are up by 4% (as at end July). German truck exports have also “increased significantly”, by 57% since the start of the year. “This year we expect to see the domestic market for heavy vehicles climb to 64 000 units,” says Matthias Wissmann, president of the Verbund der Deutsche Automobile Industrie (VDA; the Association of the German auto industry). That represents growth of 5%.

The first quarter of 2010 saw a return to some unmistakable growth rates in freight transport within Germany. Forecasts for the year as a whole in Germany, for example, assume an increase in road freight transport of over 6%. “In the coming year, we could reach the volume we had in 2008,” says Wissmann. Despite all the positive signs, he says the crisis is not yet over. It will take “quite a while” to get back to pre-crisis commercial vehicle sales levels.

Global FOCUS is a monthly update of international news relating to the commercial vehicle industry. It is compiled exclusively for FOCUS by Frank

Published by

Focus on Transport

focusmagsa