Still okay, but will that stay?

Despite some quarter-related confusion caused by the Easter holidays this year, the first half of 2013 proved particularly noteworthy, writes FRANK BEETON.

With the first half of 2013 now a matter of record, the South African truck market has grown by a margin of 6,8 percent, when compared to the equivalent six month period in 2012. Given the widespread concerns that had been expressed over conditions in the local economy during this period, together with the continuing difficulties that were experienced by a number of the country’s most important trading partners, this outcome was somewhat surprising, but certainly highly satisfactory.

The total sales results for May and June set new individual month benchmarks for the period since September 2008, suggesting that the long-awaited recovery from the slump of 2009 had, at last, materialised.

Digging deeper into the detail, the sales volume recorded for the entry-level medium commercial vehicle (MCV) segment in the month of June was the highest for any single month in five years, and, in the case of the cruiserweight heavy commercial vehicle (HCV) grouping, the same month’s outcome was the best since October 2012. Premium payload extra-heavy commercial vehicle (EHCV) sales continued to perform well, although bus volumes were still running behind those recorded up to the equivalent point one year earlier.

In comparison with the outcome for the first quarter of 2013, the market grew by almost 17 percent in the second quarter. Some of this accelerated growth could be ascribed to the timing of the highly disruptive Easter season mainly during the month of March in 2013, whereas the equivalent period had fallen in April

last year.

This period, with its numerous public holidays, tends to encourage the taking of at least one week’s leave by numerous employees, which can delay the delivery process of those commercial vehicles that require extensive body mounting and/or modification intervention. Consequently, the Easter period has fallen into two different quarters in 2012 and 2013, which has distorted the quarter-on-quarter market comparison to a highly significant degree. For this reason, the comparison between the first six months of 2013 and the equivalent period of 2012 provides a more accurate indication of the actual rate of market growth.

This period, with its numerous public holidays, tends to encourage the taking of at least one week’s leave by numerous employees, which can delay the delivery process of those commercial vehicles that require extensive body mounting and/or modification intervention. Consequently, the Easter period has fallen into two different quarters in 2012 and 2013, which has distorted the quarter-on-quarter market comparison to a highly significant degree. For this reason, the comparison between the first six months of 2013 and the equivalent period of 2012 provides a more accurate indication of the actual rate of market growth.

The market performance in the first half of 2013 was particularly noteworthy given the prevailing macro-economic scenario. Although there have been some signs that the slide in rand foreign exchange values may have slowed down, the recent announcement of a steep increase in local fuel prices – despite the apparent stabilisation of the international oil price prior to the Egyptian crisis – still presented a serious short-term challenge to the transport community. It also provided strong rationale for updating fleet technology with the latest in products and management systems.

It has also become apparent that, despite the difficulties being experienced in our traditional overseas export markets, business between South Africa and its northern neighbours has been expanding rapidly, and this has undoubtedly added its own measure of weight to the local demand for commercial vehicles.

SEGMENTATION DYNAMICS

As mentioned, the major impetus to market growth during the first half of 2013 has been provided by the entry-level MCV segment, which has run more than 10 percent ahead of its equivalent performance during the first six months of 2012, while both the HCV and EHCV segments have grown at rates well in excess of six percent in the same time-frame comparison.

Bus sales, alone, have returned negative year-on-year growth over the last six months, being some 17,5 percent off their first-half 2012 total, but prospects for this segment have recently improved with the announcement of important BRT-related transactions in Johannesburg and Cape Town, and bus sales promise to return to positive growth during the second half of the year.

In terms of segment market shares, the EHCV grouping continued to lead the overall standings at the end of the second quarter with 43,1 percent penetration, followed by the MCV category with 36,5 percent, HCVs with 17,2 percent and buses at 3,1 percent. This compares with levels of 40,2 percent, 39,6 percent, 16,7 percent and 3,5 percent, respectively, that were recorded at the end of the preceding quarter.

The slight widening of the gap between the EHCV and MCV groupings is most likely a reflection of South Africa’s increased Africa trade, as the heavier models are more likely to benefit from ultra-long-distance linehaul operations than the smaller MCV units that are more typically employed on domestic distribution and fast freight duties.

The general quarter-on-quarter market share stability exhibited by all three goods-vehicle classes suggests that product availability has returned to normality, and that the post-2011 tsunami “catch-up” process which previously occupied the Japanese brands active in the MCV and HCV segments, has finally worked its way out of the system.

However, it is still significant that the cruiserweight HCV segment’s market share has settled somewhat below its “traditional” 20 percent level, which seems to suggest some migration of operators away from the heavier 4×2 goods models that predominate in this category.

Bus sales have been largely without any stimulation from large-volume fleet orders during the first half of 2013, but recent announcements of BRT-related purchases in Johannesburg (134 Mercedes-Benz units) and Cape Town (40 Volvo buses) promises to raise the ante significantly over the following six months. With BRT systems also being developed and planned in Tshwane, Durban, Rustenburg and other towns, prospects for the bus segment are now looking considerably brighter.

Finally, in the review of application performance within the entry-level MCV segment, it should first be remembered that many bus units are included in the panel van grouping, while some tippers are still being lumped together with chassis-cab-derived freight carriers. The reported MCV segment application penetration levels for the second quarter were: freight carriers 62,9 percent, integral vans 32,4 percent, with buses and tippers equal on 3,1 percent

MANUFACTURER PERFORMANCE

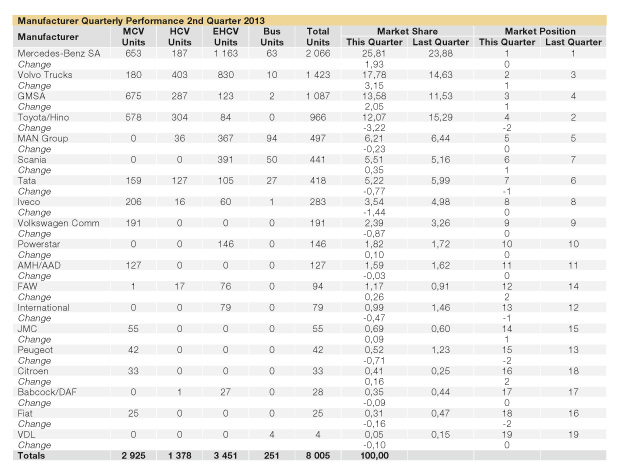

The accompanying chart illustrates the relative market performance and ranking of each participating manufacturer in the quarter just completed, as compared to the returns for the previous quarter.

The groupings contained in this section of the report are based on the rule that, if a manufacturer/group sells more than one brand through its distribution channels, then all sales for those brands will be consolidated in the result for the manufacturer/group.

Thus, Mercedes-Benz includes Freightliner and Fuso, Toyota/Hino contains both brands, MAN includes Volkswagen (Constellation) trucks and Volksbus passenger units, but not VW commercial vans (listed separately), while Volvo Trucks includes UD Trucks, Mack and Renault. This last change recognises the very visible and freely acknowledged connection that now exists in South Africa between the Volvo Group and UD Trucks SA.

Mercedes-Benz South Africa

Perennial market leader Mercedes-Benz South Africa (MBSA) maintained the premier position in the second quarter, with a market share improvement of almost two percentage points, capturing slightly more than one-quarter of all the available sales, while also achieving overall leadership of the premium EHCV segment.

In terms of the individual brands making up the group, Freightliner provided the greatest growth momentum with 1,3 percentage points’ improvement in market share to finish at 5,5 percent, followed by Mercedes-Benz (0,5 percent improvement for 16,5 percent share) and Fuso (0,1 percent improvement for 3,8 percent share).

With Mercedes-Benz’s entire European truck line-up having been renewed in the run-up to imminent Euro-6 implementation, it can be expected that some new models, and possibly even new nameplates to the South African market, will be on view at the Johannesburg International Motor Show (JIMS) in October.

Volvo Trucks

A stellar performance by UD Trucks, which included a quarter-on-quarter volume boost of more than 50 percent for a market penetration of 11,5 percent, helped to propel the Volvo-led grouping to 17,8 percent market share, and second market position overall, in the second quarter. This improved on the group’s first quarter outcome by 3,2 percentage points and one market ranking position.

The other constituent members Volvo and Renault Trucks returned market share improvements of 0,4 and 0,2 percentage points, to score overall penetration levels of 5,75 percent and 0,6 percent respectively.

It was notable that UD’s contribution to the group has resulted in substantial participation in both the MCV and HCV segments, something which the local Volvo family has lacked in the past, to the point where the group achieved overall leadership of the cruiserweight HCV category in the quarter under review. Maintaining this position will require great emphasis to be placed on the future sourcing of competitive MCV and HCV products from the group’s overseas brand centres.

GMSA (Isuzu)

Improved across-the-board sales of Isuzu N, F and G Series trucks have continued to push this manufacturer up the local sales charts, and the second quarter witnessed yet another step forward into third position in the rankings. The resulting 13,6 percent market share achieved in the April to June period is the best recorded by this brand since this series of market reviews was first published in 2006.

Notably, the Isuzu N Series also headed up the MCV order of merit during the second quarter of 2013, with Isuzu’s creative exploitation of niche AMT, double cab and 4×4 models contributing significantly to this achievement. It seems that the increasing recent involvement of Isuzu Motors’ Japanese management in the South African operation has paid handsome dividends.

Hino/Toyota

This Hino-led grouping which includes Toyota’s Dyna MCV model, suffered a substantial 3,2 percentage point market share loss in the second quarter when compared to its January to March performance, thereby being displaced from its traditional second position market ranking, to occupy fourth place in the second quarter.

Recent product events have included the introduction of a Hino 300 Series dedicated bus model with bodywork by Busmark 2000, while 8×4 and freight carrier additions to the 700 Series EHCV lineup are expected to appear at JIMS.

MAN Group

The MAN Group also failed to match the rate of market growth despite a sales volume increase of 12,7 percent in the second quarter, although the resulting one-quarter percentage point loss in penetration was not enough to disturb the group’s fifth position in the rankings.

Subsidiary brand Volkswagen returned an improved quarter-on-quarter performance, raising its market share by 0,2 percentage points to 1,2 percent, and made a substantial contribution to the group’s retention of overall leadership in the bus segment. Recent publicity has centred on the sale of 140 MAN TGS tractors to the Reinhardt Group, and details of some new local management arrangements are expected to be announced during the

Subsidiary brand Volkswagen returned an improved quarter-on-quarter performance, raising its market share by 0,2 percentage points to 1,2 percent, and made a substantial contribution to the group’s retention of overall leadership in the bus segment. Recent publicity has centred on the sale of 140 MAN TGS tractors to the Reinhardt Group, and details of some new local management arrangements are expected to be announced during the

third quarter.

Scania

Substantially increased EHCV truck deliveries during the quarter just completed propelled Scania to a market share increase of 0,4 percentage points, an improvement of one position in market rankings to sixth place, and an overall market penetration of 5,5 percent. Scania has recently embarked on an image-building campaign for its bus models, emphasising the company’s historic participation in this business going back to 1909.

Tata

Tata’s second quarter performance was very similar to that of the first quarter in terms of total volume sold, but in a market that grew some 17 percent, this resulted in a penetration loss of 0,8 percentage points to end at 5,2 percent share, and demotion by one position to seventh in the market standings. Recent advertising activity has centred on the promotion of new models including the five-tonne LPT 913, 10-tonne three-axle LPT 1918SC, and 14-tonne LPT 2523.

Iveco

Following two preceding quarters of increased sales volumes, Iveco’s fortunes declined in the second quarter, with a market share reduction of 1,5 percent when compared to the company’s January to March outcome. The resulting 3,5 percent market share was sufficient, however, for the retention of eighth place in the market rankings.

Assembly of trucks and buses at the Larimar Group joint venture in Rosslyn is expected to commence in the near future, while considerable publicity has recently been given to the local launch of the MCV Daily 4×4 chassis/cab model. Iveco has also announced a return to full participation at this year’s JIMS exhibition, where the Stralis Highway will be on view.

Powerstar

Powerstar was the first manufacturer of Chinese origin to report its sales to the Naamsa system and, during the quarter just completed, it retained its pre-eminent position among brands from that country. A quarter-on-quarter volume increase of almost 24 percent resulted in a market share of 1,8 percent, and 10th position overall in the rankings. Powerstar’s premium V3 linehaul truck-tractor is currently undergoing a local testing programme, ahead of market introduction.

AMH/AAD

The Korean-sourced Hyundai HD Series of light trucks, reported in Naamsa’s MCV segment, maintained its 1,6 percent share of the expanding market during the April to June timeframe, with a retained 11th position in the overall market rankings.

FAW

Chinese manufacturer FAW strengthened its performance in the local market significantly during the second quarter, achieving a penetration improvement of 0,3 percentage points to reach 1,2 percent of the overall market, coupled with a promotion of two ranking positions to finish in 12th place. Recent advertising has centred on the FAW J6 premium hauler, following the delivery of ten units to the Mpisi Group. This model will also be made available with an automated transmission and rear air suspension.

NC² – International Trucks

This brand has lost nearly half a percentage point of market share in the comparison between the second and first quarters, and has been demoted by one place to 13th position in the rankings. During 2012, the average quarterly sales volume of International brand trucks in South Africa was 144 units. Thus far in 2013, the average is just 90 units.

The local market has indicated clearly, over many decades, that it has an ongoing requirement for premium trucks of American origin, and the only other local franchise that currently fits that bill is Freightliner. It is instructive, therefore, to note that the increase in Freightliner’s quarterly going rate in 2013 almost exactly matches the quantum of International’s decline, which suggests that the local demand for this type of truck persists. We are not aware of any rational product-related explanation for International’s loss of momentum, so we can only assume that corporate issues might be at play.

JMC

JMC’s reported participation in the market was still restricted to the MCV segment during the second quarter, and the results showed a penetration improvement of 0,1 percentage points to reach 0,7 percent. JMC’s market ranking improved by one position, placing it 14th in the overall standings.

Babcock/DAF

Babcock’s second quarter performance declined slightly from that achieved in the preceding review period, with a market share of 0,4 percent and a retained 17th position in the rankings. The organisation recently opened a new dealership in Westmead, on the outskirts of Durban.

VDL

Bus chassis specialist manufacturer VDL’s performance continues to fluctuate widely from quarter to quarter. The second quarter sales total of four units maintained 19th, and last place in the rankings, with a market share reduction of 0,1 percentage points from its first quarter result.

European van manufacturers

Of the four vehicle manufacturers continuing to compete in the MCV segment of this market with European-sourced integral van-derived products, only Citroen improved its position in the most recent quarter-on-quarter comparison, boosting its market share by 0,2 percentage points. It also gained promotion by two positions to occupy 16th place in the overall standings.

Volkswagen Commercials was able to retain its ninth position in the listings, but gave up 0,9 percentage points in market share, while Fiat and Peugeot each lost two positions in the rankings, finishing in 18th and 15th spots respectively, with second-quarter individual market shares of 0,3 percent and 0,5 percent. Citroen recently launched 15-, 16-, and 19-seater taxi versions of its Relay van on to the local market.

Non-reporting manufacturers

Readers should note that local sales volumes of several commercial vehicle brands, including DongFeng, Foton and Ashok Leyland, are not yet reported to Naamsa, and are, therefore, excluded from the comments and data contained in this report.

GENERAL MARKET COMMENTS

While the performance of the South African truck market has been surprisingly strong during the first half of 2013, there is a possibility that some element of pre-emptive buying may have been present in the market, with operators having pulled their procurement forward to avoid the full impact of vehicle price increases stemming from the recent decline of the rand versus the US dollar, Chinese yuan and euro.

However, the relative performance of the local currency, against other important commercial vehicle sourcing currencies, such as the Brazilian real and, particularly, the Japanese yen, has been considerably stronger during the period from the beginning of this year up to the end of June, with important potential implications for the competitive balance within the market.

If the pre-buy theory turns out to be valid, however, monthly volumes may soften somewhat during the second half of the year, making the 29 000 unit final market total outcome, that recently seemed likely, more difficult to achieve. The reported results of the months immediately ahead will, therefore, be very important in determining the ultimate magnitude of the 2013 truck market.

Published by

Focus on Transport

focusmagsa